Roman Danaev

Today we are going to talk about one of the four vehicle categories, the S category. What does a category for written-off vehicles mean? In general, a category S vehicle is the one that has sustained structural damage. For example, it can be a vehicle with damage to the undercarriage resulting from an accident.

Repairing structural damage to cars is usually quite expensive for insurance providers. Therefore, they tend to write off such vehicles to cut expenses. This helps avoid administration costs and those associated with vehicle repairs, which can exceed the total cost of the undamaged car before the accident. Let’s take a closer look at category S cars in this article.

What is cat s?

There are four write-off categories: A, B, S, and N. As we mentioned above, the S category refers to vehicles with structural damage. This damage can be minor (e.g., a dented bumper, a fender, or a broken headlight) or significant, which hinders further operation.

Of course, it is possible to repair this type of car and make it safe to drive again. But often, the cost of such repairs combined with all new parts will exceed the total cost of the vehicle. In addition, the vehicle must be registered with the DVLA (Driver and Vehicle Licensing Agency) and be accredited by an engineer after the repairs. If all goes well, the car gets a registration number that starts with a “Q.”

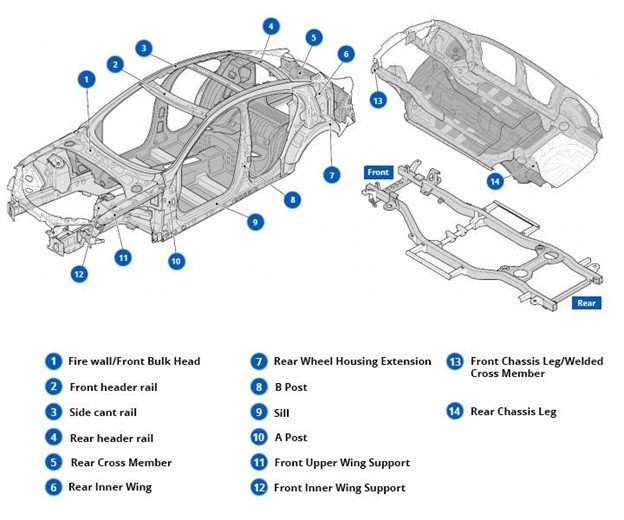

What is the structure of a car?

At first glance, the car looks pretty complicated, but if you look at the basic structure, it’s actually pretty straightforward. Therefore, don’t be apprehensive about studying the car’s components even if you don’t have technical knowledge. Let’s take a look at the operation principle of a regular commercial car. The image below is provided by the Association of British Insurers (ABI), which is the UK’s leading financial services trade association defining the salvage code.

What is the difference between cat s and cat n?

The main difference between these categories was the type of damage the vehicle sustained. A cat S car has structural damage. A category N car, on the other hand, only has bodywork damage. In other words, cosmetic damage that does not affect the structure and chassis.

Of course, a category N car is still considered written off and needs to be repaired. But it will be much easier and cheaper for both the insurer and the owner to return the car to its former condition. An N-category car, even with repairs, sometimes costs significantly less compared to a brand-new car.

Find car finance deals with the best rates!

Get a quoteIs cat s the same as cats c?

Not really. Before the recent reclassification of vehicle decommissioning categories, category S and category N vehicles were referred to as Categories C and D, respectively.

Cars are categorised as C if they have severe structural damage. In addition, the car needs to be appraised by an Appropriately Qualified Person (AQP). After this evaluation, it requires an estimate of whether the repair costs would exceed the car’s value. If so, the car is placed in category C, and if not, it is moved to category D. Such vehicles need to be re-registered with the DVLA before being put back on the road.

The new Cat S classification (short for structurally damaged) replaces Cat C. The change was made to better account for all repair methods. The main difference is that the evaluation is now based on predetermined criteria. What is more – this method allows emphasising the damage that may affect the safety of the vehicle rather than the repair costs.

What are the other categories for insurance write-offs?

After an analysis conducted by the ABI (Association of British Insurers), four insurance categories were defined in 2017 – namely, categories A, B, S and category N. Let us take a closer look at each of them and highlight their main differences.

| CAT A | Cars with very serious damage. The components that give a vehicle its strength may have been heavily damaged or worn out. Whatever is left of the car is scrapped and destroyed. |

| CAT B | The second most severe level of damage to the vehicle. Only the chassis and body shell must be scrapped. The remains of such a car can be stripped for salvage and used on other vehicles. |

| CAT S | Decommissioned vehicles that have structural damage to the structural frame or chassis that can be repaired and put back to use again. However, the vehicle must pass a mechanical inspection by an accredited engineer and be re-registered with the DVLA (Driver and Vehicle Licensing Agency). |

| CAT N | Vehicles that have received non-serious and non-structural damage. They can be repaired and returned to service. A cat N vehicle does not need to be inspected or re-registered before being returned to the road. |

Who repairs category s cars?

Generally, such repairs are handled by independent workshops with specialised equipment for salvage works. Since such cars sell at a significant discount compared to non-withdrawn vehicles, some people opt to buy and repair them with relatively little overhead.

However, take note of this: by law, the work of such garage shops is not subject to independent verification. Therefore, conduct an independent expert appraisal to make sure your car is safe on the road.

Dealing with the DVLA

If your vehicle has been written off under category S, you will need to inform the DVLA. You will be given a new V5C (vehicle log book) with a note stating that the vehicle has been written off. Why is it necessary? To protect potential buyers from unknowingly purchasing a previously written-off vehicle.

All of these procedures should be taken care of by your insurance agent. Under the same scheme, your car insurance agent should notify the organisation about the disposal or sale of your car for salvage. If this is the case, you should get confirmation from the DVLA that you are no longer responsible for your vehicle.

Dealing with insurers

A new car always needs insurance. But if you bought an S-car, you may encounter unforeseen difficulties. Let’s discuss what to consider when insuring a cat S car.

Can I insure a category s car?

Like any car, an S-car is also insurable. The main conditions you need to meet are having your vehicle repaired to its complete working order and having it independently assessed by an expert. This way, the insurers will be sure that the car is driveable and can be insured.

Will I have to pay more for a cat s car insurance?

Unfortunately, it is possible. Any insurance is a risk to the insurance company. And a car that has been previously repaired and is more likely to break down than a new one is an even greater risk. Such cars’ previous and current condition is uncertain, as is their market value after a second write-off. That’s why most insurers offer deals on cat S cars at a much higher price.

Can I drive a cat s car knowing it is safe?

You can if you put some effort into it. Once the car has been repaired, re-registered with the DVLA and assessed by an independent expert, it is safe to drive. However, before you get behind the wheel, be sure to check the re-registration documents – this is your main guarantee of safety.

Buying a cat s vehicle

So, you decided to buy a car from category S. Here is what you need to know before buying, plus all the details you should pay attention to.

When should I buy a cat s?

The question of whether to buy a used car comes down to a simple calculation. S- and N-category cars usually cost much less than their counterparts of the same year, make, and model that haven’t been written off. If you are buying a car for personal use, it can actually be a good option, especially if you want to minimise the expenses. The key is to make sure the vehicle has been properly repaired and re-registered.

If you are thinking about buying a damaged car to repair and resell it, carry out the cost-benefit analysis. Repairs may end up costing a lot more than you save. If this is the case, avoid buying a category S car and look elsewhere.

Are there any risks when you buy cat s vehicles?

First of all, poorly repaired S-category cars can be unsafe to drive – for example, if they received substandard repairs or the specialists used low-quality salvage parts. There are other risks, but they are not life-threatening. For instance, the insurance cost may be higher, and the resell value may be lower than you think.

In addition, a record that your car was in the S-category generally reduces your chances of selling your car. After all, many drivers avoid buying decommissioned vehicles.

How do I check if the car was in category c?

Before signing any documents, be sure to look through all the documents on the car. Remember that a car dealership has no legal right to hide the car’s S-category classification. But if you still suspect something of the kind, have a full HPI check with a firm that provides this kind of information on vehicles.

Things are much more complicated with buying cars from private individuals. The problem is that they may not know that their car was once written off. In that case, be sure to do a full HPI vehicle check on any used car.

Is there a difference in price between a cat s car and a non-write-off?

At first glance, a written-off car seems much cheaper than a new one. But if you look at the situation in the long term, it is hardly a cost-efficient purchase. For example, you may spend significant amounts of money on repairing previously damaged salvage parts in the future. In this case, the money you save will be spent anyway.

Does buying a cat s car require a license?

No, it is not necessary. The process of buying a car doesn’t require a license. Of course, you will need it to drive the vehicle.

Do I need a vic check for my cat s car?

The Vehicle Identity Check (VIC) scheme in the UK was abolished in 2015. So, you don’t have to go through it when buying your car. But if you want your car back in use after damage, you can apply for a replacement V5 registration book from the DVLA.

Selling a cat s vehicle

Now, let’s say that you want to sell your cat S car. What procedures do you need to go through to sell it, and what documents do you need to submit? Let us go over everything in order.

Is selling a cat s car legal?

There is nothing illegal about selling an N or S vehicle if you declare its condition. Even if the car has been repaired to the same condition it was in before the accident, you still have to declare category C on the application. Declaration of Cat N or Cat S status is a prerequisite for selling or exchanging the car. Otherwise, the new owner may sue you for damages.

Who will buy my cat s vehicle?

In most cases, it is salvage buyers who get cars with damages and resell them for parts. If your vehicle has been restored and become roadworthy, anyone who is interested in a cost-efficient deal can buy it.

Insuring a cat s vehicle

The final questions that all buyers of S-cars have: How do you insure a decommissioned car? Could there be any difficulties along the way? Let us explore these concerns as well.

Is it possible to insure a cat s vehicle?

Yes, it is absolutely possible to insure an S-category car. But it is worth remembering that insurance companies consider this category to be high-risk. It is not easy for insurers to determine the current condition of the car or its market value, especially if the repairs were made without an independent assessment.

Will this type of insurance cost more than usual?

Based on all the information from above, you can probably guess that the answer to this question is most likely, yes. The market value of the car is unclear if it is written off a second time. Therefore, insurance companies will certainly agree to insure an S-category vehicle but at a much higher price.

How to check if a car is a cat s?

The easiest way to learn a vehicle’s category before buying it is to check its history. An HPI check will provide information on whether the car has been categorised as a write-off by the insurance company.

This is important to check before paying for the car because it will affect its overall value. If you fail to do so, you risk paying more for the car than it is actually worth on the market at the time.

Contents

- What is cat s?

- What is the difference between cat s and cat n?

- Is cat s the same as cats c?

- What are the other categories for insurance write-offs?

- Who repairs category s cars?

- Dealing with the DVLA

- Dealing with insurers

- Can I drive a cat s car knowing it is safe?

- Buying a cat s vehicle

- Selling a cat s vehicle

- Insuring a cat s vehicle

- How to check if a car is a cat s?

Latest News

| Loan amount: | £16,000 |

|---|---|

| Length of loan: | 60 months |

| Interest rate: | 12,9% |

| Amount of interest | £5,793.84 |

| Total payment: | £21,793.84 |