Car insurance is essential, and driving without it leads to a £300 fine, 6 points on your licence, or even an unlimited fine and disqualification if taken to court. So, whatever car you have, you need it. However, if you’re currently shopping for a new vehicle, insurance premiums may actually be a deciding factor.

Electric cars, while more expensive to buy, usually have lower running costs. The key question is whether their insurance is actually cheaper and whether it balances out the higher purchase price. Let’s find out.

Before we begin, here’s a reminder that Carplus can help you buy the electric car you want on good terms.

How much does it cost to insure an electric car?

You may have heard that driving an electric car can be cheaper than a petrol or diesel car in the long run, and that’s very often the case. Charging at home, comparing and switching to the best energy tariff, and using available grants are some ways to make running an electric car cost less than an ICE vehicle.

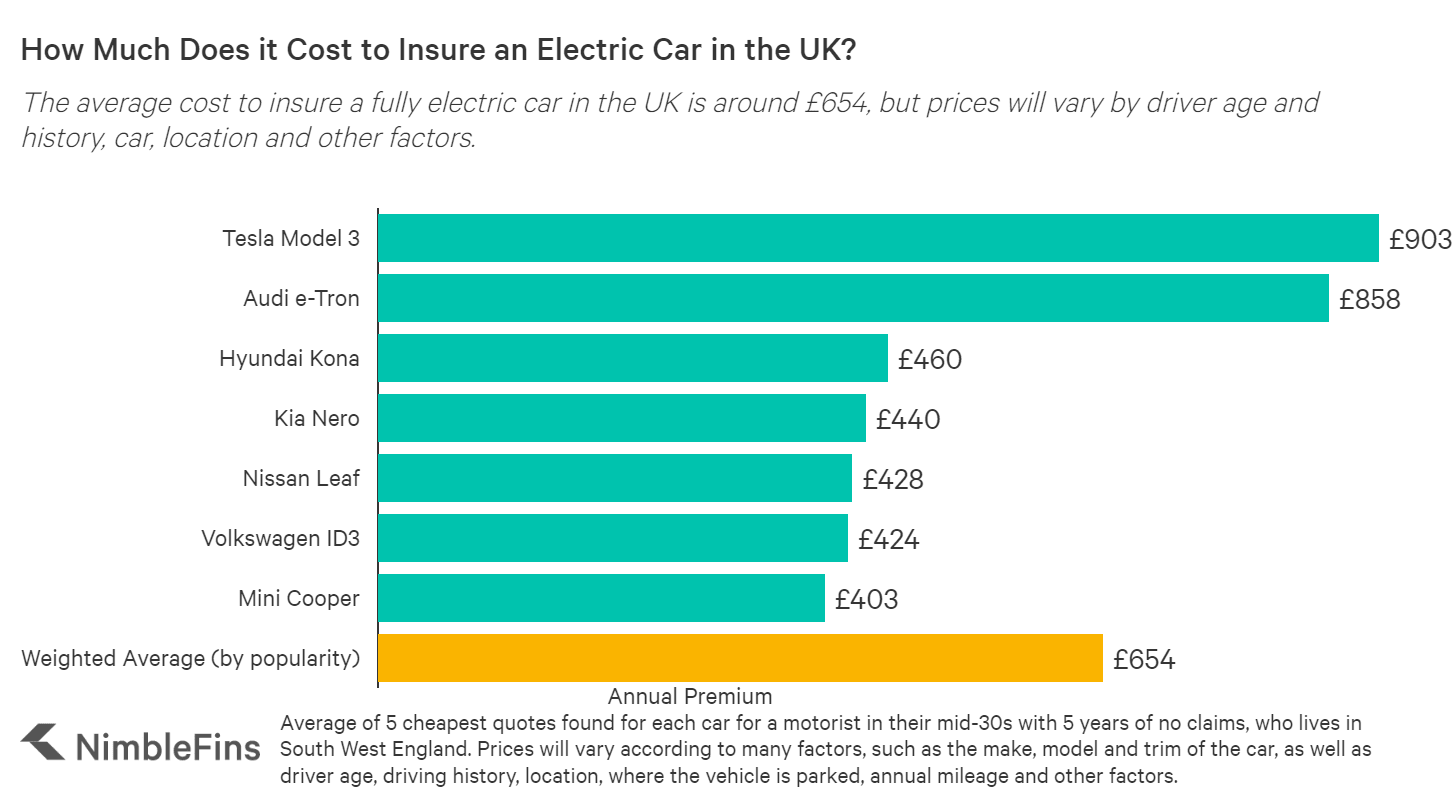

However, amidst rising costs for everyday items like groceries and other purchases, the automotive industry is not immune to price increases. One major cost associated with electric cars is insurance. On average, insuring popular electric vehicle models in the UK costs about £654. Prices vary widely, though, ranging from approximately £480 to £1,600. The cost depends on various factors, which we’ll discuss further in the upcoming sections of this article.

For comparison, insurance costs for electric cars are up to 13% higher than equivalent hybrid or petrol vehicles, based on our comparison of models like BMW 330e (PHEV) vs. 330 (petrol), Mini Cooper Countryman SE (PHEV) vs. S (petrol), Renault Clio E-tech (hybrid) vs. Clio (petrol), and Kia e-Niro (electric) vs. Niro (hybrid). Across these comparisons, electric cars generally cost more to insure than hybrids, and hybrids cost more than petrol cars.

However, recent premiums for models like Kia Niro (PHEV vs. electric) and Mini Cooper (petrol vs. electric) have become nearly equal, with the difference often less than 1%. The insurance cost gap between electric and traditional cars is narrowing!

Key factors that influence insurance rates for EVs

Here are the main factors that determine your car insurance costs, ranked by their importance:

- Driving history — Previous claims, speeding offences, or points on your licence can significantly impact insurance premiums, reflecting perceived risk on the road.

- Age — Young and new drivers, as well as those over 75, face higher insurance premiums due to the higher accident risk.

- Postcode — Living in a busy city with more vehicles or in areas prone to crime or flooding increases insurance costs due to higher risks of damage or theft.

- Occupation — Working in a high-stress industry or a job that involves driving leads to higher insurance rates due to potential distractions on the road and additional time spent behind the wheel.

- Mileage — The more you drive your EV, the higher the likelihood of being in an accident, which increases insurance costs.

- Parking location — Having a private driveway or garage lowers insurance costs since it reduces the risk of collisions and theft while parked compared to street parking.

- Vehicle modifications — Adding expensive sound systems increases insurance costs, while security features like immobilisers or rear parking sensors lower them.

- Marital status — Sharing an electric car between married couples affects insurance costs, potentially increasing premiums due to shared risk.

How does EV insurance differ from ice vehicle insurance?

Many deciding factors, such as basic risks and liabilities associated with driving, remain consistent across the board. However, even with many similarities in vehicle considerations, there are reasons why electric car insurance is often more expensive than for ICE vehicles:

- Repair costs and availability of parts— EV technology is newer, so spare parts may be less common or highly specialised, leading to higher repair costs. Insurers account for this in their pricing.

- Car value — On average, EVs are more expensive than traditional cars. This means it would be more costly for insurers to replace a stolen or written-off EV.

- Specialised mechanics — EVs require specialised garages and trained mechanics, which increases maintenance and repair costs.

- Performance — Electric motors provide instant power, which enables rapid acceleration. Some insurers consider this performance capability a risk factor.

- Security features — On the positive side, many EVs are equipped with advanced safety features, which reduce the likelihood of accidents and claims. At the same time, the cost to repair or replace these advanced systems is higher.

It mostly boils down to how the technological differences between EVs and traditional cars affect the total cost of the policy.

On the whole, it’s a complicated issue. On the one hand, EVs have simpler maintenance needs with fewer moving parts, so they don’t require as much routine upkeep, such as brake or oil changes. However, if something does fail, the repairs are costly, especially for components like the battery or electric motor. In the end, consumers end up paying higher premiums.

What does and doesn’t electric car insurance include?

EV insurance typically includes coverage similar to traditional car insurance, with just a few distinct aspects.

Includes | |

Comprehensive coverage | Damage to your own vehicle from accidents, theft, fire, and vandalism, plus third-party liability. |

Third-party liability | Damage or injury to third parties and their property |

Personal injury | Medical expenses resulting from accidents |

Uninsured driver cover | Damage caused by uninsured or hit-and-run drivers |

Extras | Battery coverage, charging equipment |

Does not include | |

Wear and tear | Damage due to normal wear and tear of the vehicle |

Battery degradation | Loss of battery capacity over time |

Public charging stations | Damage or loss of property at public charging stations |

Specific details vary by policy, so review the details carefully to understand what coverage is provided for your vehicle.

What insurance group will my electric car be in?

Insurance providers classify cars into groups ranging from 1 to 50 to determine insurance premiums. These groups are set by the Association of British Insurers and managed by Thatcham Research.

Whether a car is electric doesn’t automatically affect its insurance group — it’s more about specific details like these that insurers consider. On average, EVs fall into insurance groups ranging from 10 to 40.

Reducing your electric car insurance costs

If your insurance is too expensive even by EV standards, there are steps you can take to lower your costs:

- Choose a higher excess. Your insurance excess is what you pay out of pocket when you make a claim. Opting for a higher excess lowers your monthly premiums but be aware that it means you’ll receive less money if you do need to make a claim.

- Take advanced driving lessons. If you’re a young or new driver, insurance companies view you as a higher risk. Taking advanced driving lessons demonstrates your safe driving skills and may potentially reduce your premiums.

- Install a black box. A black box monitors your driving habits, such as speed and time of use. If you drive responsibly and stick to the rules outlined in your policy, it should make a difference

- Enhance vehicle security. Some electric cars are targets for theft. Consider improving security by installing GPS tracking or parking in a secure garage. These measures show insurers your vehicle is less likely to be stolen.

- Watch your annual mileage. Lower annual mileage leads to lower premiums, as it reduces the likelihood of accidents.

- Shop around and compare quotes. Different insurers offer varying rates, so it pays to compare policies from multiple companies to find the best deal for your specific needs and circumstances.

What to consider when insuring an electric car

When insuring electric cars, there are extra factors to consider compared to traditional petrol or diesel vehicles. In addition to standard insurance costs and repair considerations, owners can opt for additional coverage options. For example, many choose to add:

- Battery cover — Electric cars rely on expensive lithium-ion batteries, which are critical to their operation. Protecting these batteries with specific insurance coverage safeguards against the high costs of repair or replacement.

- Charging cable cover — Because electric cars are often charged outside the home, the cables used for charging are vulnerable to theft or damage. Having coverage for these cables means they can be easily replaced if needed.

Also, it’s uncommon but possible for EVs that regularly use public charging stations to experience issues due to malfunctions. These cases are covered by Public Charging Station Damage coverage, which specifically safeguards against the damage caused by the charging station equipment.

Is EV insurance becoming cheaper?

As EVs gain popularity on UK roads, with over 1.1 million currently in use, insurance costs are slowly going down. This trend is influenced by various factors.

Mechanics and auto shops are becoming more adept at servicing and repairing them, and parts are more easily accessible. These improvements help lower maintenance expenses, which in turn decrease insurance premiums for electric vehicles.

Also, more automakers are introducing affordable models and expanding the accessibility of EVs. This encourages insurance companies to reduce risk profiles associated with these vehicles.

Cheapest electric cars to insure

Here are the cheapest electric cars to insure:

- Smart EQ ForFour (insurance group 9) — Ideal for city driving with its compact size and 70-mile range.

- Volkswagen e-Up (insurance group 10) — Offers up to 160 miles of range, suitable for occasional longer trips.

- SEAT Mii Electric (insurance group 12) — A budget-friendly alternative to the VW e-Up, with similar specs.

- Renault Zoe (insurance group 14) — A practical small car with up to 238 miles of range.

- Volkswagen e-Golf (insurance group 15) — Recognisable and approachable, with the same feel as its petrol/diesel counterpart.

Other notable mentions are the Hyundai Ioniq Electric (insurance group 16), the Volkswagen ID.3 (insurance group 18), and the Kia Soul (insurance group 18).

Carplus: your partner in affordable electric car financing

At Carplus, we're committed to making electric vehicle ownership accessible and affordable. As a leading UK car finance broker, we offer tailored financing solutions for electric cars. Our competitive APRs and flexible terms ensure you can drive the EV you want without breaking the bank. Whether you're eyeing a compact city runabout or a long-range family car, our expert brokers will help you find the perfect finance package. With Carplus, you can enjoy the benefits of electric motoring – lower running costs, zero emissions, and cutting-edge technology – while keeping your monthly payments manageable. Don't let the higher purchase price of EVs deter you; let Carplus make your electric dreams a reality.

Conclusion

Electric car insurance used to be more expensive because of factors like the need for specialised mechanics, low availability of parts, and the overall car value. However, as more electric vehicles are registered in the UK, more mechanics are trained in EV technology, and parts become more available, insurance costs are decreasing. This makes switching to electric cars more affordable and a smart choice for both your budget and the environment.

Table of Contents