Roman Danaev

Car financing has become the most popular way to buy a vehicle - and it does not matter if it is new or used. Small monthly payments attract far more people than the option of paying a large sum at once for something that will probably need to be replaced or repaired in a couple of years.

But how do you choose the right type of finance among the dozens of options available? Today, let us talk about two of the most popular types of vehicle finance - the personal contract purchase (PCP) and the hire purchase agreement (HP).

What is Hire Purchase?

How does a car financing scheme work in general? Essentially, you borrow money from a lender to finance a dealership car. At the beginning of any agreement, you make a deposit as a guarantee that you intend to pay for the vehicle.

So, how does HP car finance work? Under an HP agreement, you borrow the balance remaining after the deposit is made. You must repay this balance over the term of the contract - usually 12 to 48 months.

The amount of the deposit and the terms of the financing will determine the monthly payment amount, including accrued interest. This amount will be presented as the annual percentage rate (APR). After the contract ends, you pay the total value of the car and all interest due, and the vehicle becomes your property.

Benefits to HP finance

- By the end of the term, which means you can keep it or sell it.

- No deposit option is available

- It is not possible to charge for mileage or damage to the car.

- New and used cars are both eligible for the program.

Disadvantages to HP finance

- It is likely to be more expensive than a comparable PCP deal in terms of the down payment and monthly repayment.

- Perhaps not the best option if you want to change your car after a few years.

- As you spread your payments over a more extended time period, there is the possibility of paying a higher interest rate.

What is Personal Contract Purchase?

PCP car finance, on the other hand, is slightly different from HP. Here, the loan amount will be much less in proportion to the car's value - the difference is offset by how much the vehicle will be worth at the end of the contract.

Any PCP contract is built around the concept of a guaranteed minimum future value. Under PCP, you take a credit not so much for the value of the car but for the difference between the GMFVand the price of the car at the time of the contract. A deposit is deducted from that amount.

But, unlike HP, you don't pay the entire cost of the car after the PCP contract ends, and you don't own it. If you want to own the vehicle, you will need to pay an additional final payment - or a balloon payment, as it is commonly called.

Benefits to PCP finance:

- When your agreement ends, you don't have to sell your car to cover depreciation.

- In most cases, the deposit is lower and monthly payments are lower than HP, since a portion of the car is deferred to the final payment.

- Cars that can be exchanged for the latest models regularly.

- Ability to refinance PCP final payment

Disadvantages to PCP finance:

- The specific terms and conditions will often include the agreed mileage limit and any charges for damage to the car.

- When your finance term ends, you'll have to make a large final payment if you decide to keep the car.

- In most cases, PCP deals are only offered on newer cars.

What is the main difference between PCP and HP?

Essentially, HP and PCP differ at the end of the contract. After you have paid the full price for the vehicle, you become its legal owner.

As a result, you have no limits on the mileage you can cover or any payouts if the vehicle is damaged. The only thing you will have to do in order to get a new vehicle is either sell your existing model or exchange it at the dealership.

In PCP financing, you only pay a fraction of the car's cost when it's time to pay off the loan. For the car to be yours, you must pay the final lump sum, which is called a weighted payment.

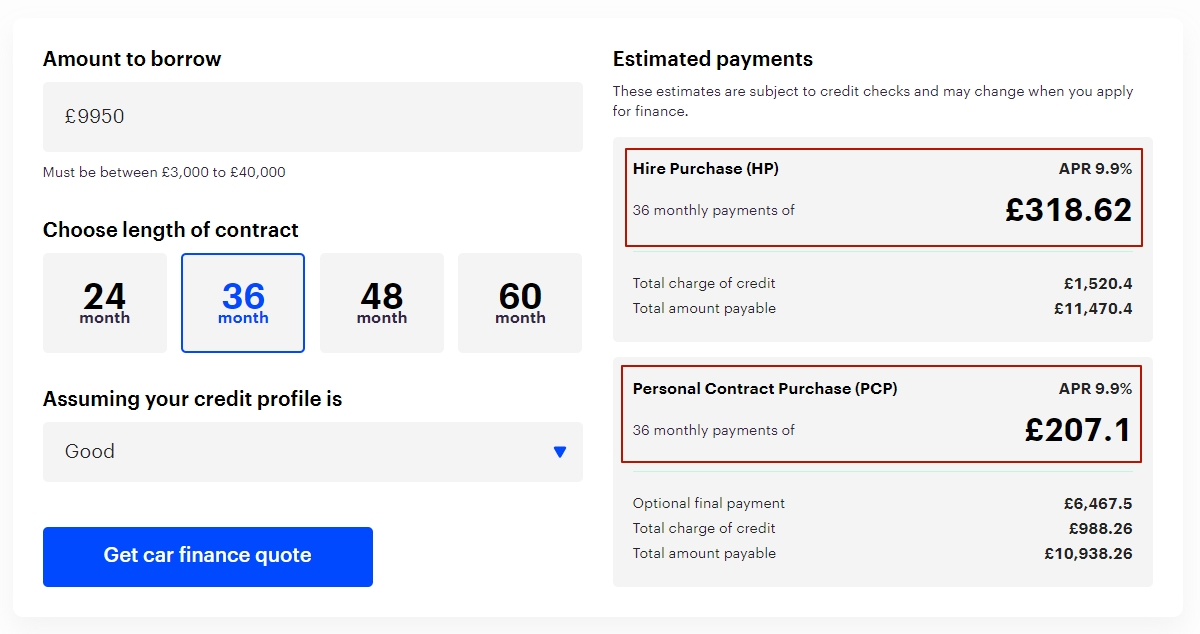

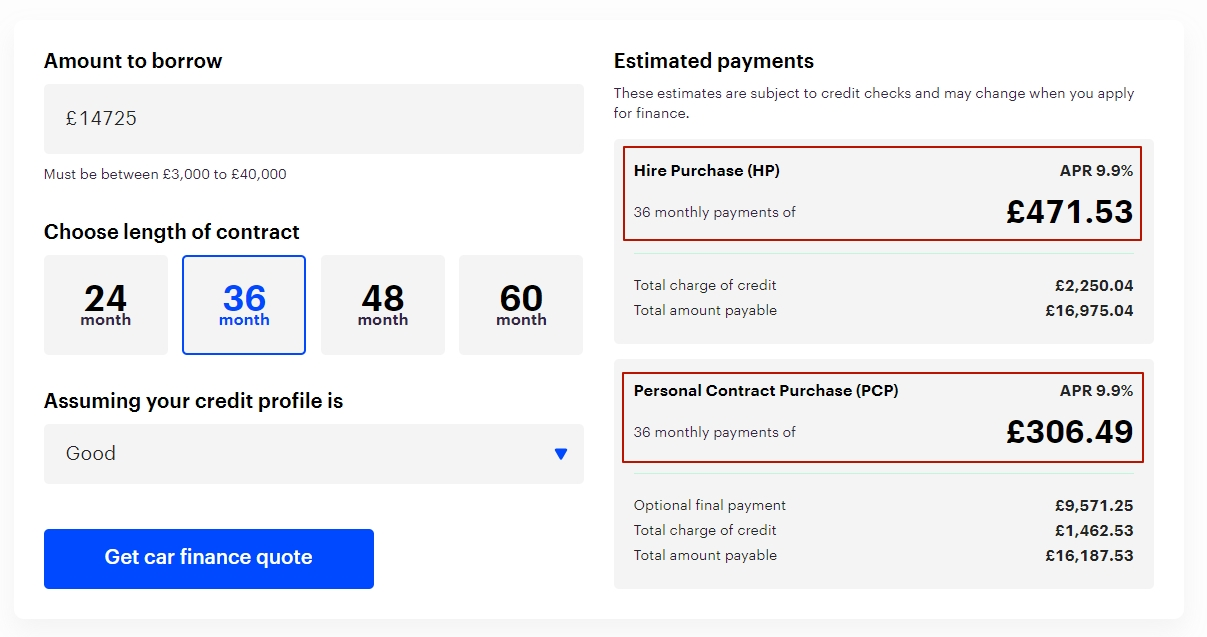

Examples of PCP & HP Agreements

Ford Focus1L Zetec EcoBoost T - Good Credit and 36 months

BMW 1 Series 1.5L SE Business 116d - Good Credit and 36 months

Comparing PCP and HP

To make it easier for you to decide on the type of financing, we have thoroughly compared PCP and HP and created a table that shows the pros and cons of each type of car finance.

| Feature | Hire Purchase | Personal Contract Purchase |

|---|---|---|

| Extra charges | No | Optional |

| Early settlement | Yes | Yes |

| Damage and excess wear | No | Yes |

| Low monthly payments | Optional | Yes |

| Mileage restrictions | No | Yes |

| Final car ownership | Yes | Optional |

| Deposit | Yes | Yes |

| Adjust finance plans | Yes | Yes |

| Balloon payment | No | Yes |

Will I Need to Pay a Deposit?

Always keep in mind that the higher the deposit you pay, the lower the amount you will have to cover each month.

In most cases during HP, yes. As a rule, the buyer pays 10% of the value of the car. There is also the possibility of zero deposit - but the monthly payment will be higher in this case.

For the PCP contract, you will also need to pay a deposit, the same 10% of the car's value. A deposit of £0 is possible, but your payments will be higher.

How Much Will I Be Borrowing?

Understanding the right amount of credit is essential in order to plan your budget and fit the monthly payment into your plans.

You pay the full price of the car plus interest, but minus the deposit amount. Since you pay the original price rather than the price difference, the HP contract amount is usually higher than the PCP contract amount.

In PCP, you pay the difference in price between what the car you choose is worth today and what it will be worth on the day the contract ends plus interest, but minus the deposit. These payments are usually less than under the HP scheme, but the car does not come into your possession at the end of the contract period.

How Much Will My Monthly Repayments Be?

The choice of a car loan scheme should be based primarily on what monthly payment you can afford.

An HP contract payment will be more than a PCP contract. This is because you are borrowing the total cost of the car.

The PCP contract payment will be less than the hire purchase contract payment because you are only borrowing a portion of the cost of the car.

Can I Adjust the Finance Plan Duration?

The flexibility of the contract and the ability to change its terms depending on your financial situation is also very important.

In the case of HP, you can choose a financing plan with terms ranging from one to seven years.

In the case of PCP, you can choose a financing plan with a term of one to five years.

Will There Be a Balloon Payment at the End of the Agreement?

A balloon payment is a guarantee that you have paid the lender the full value of the car.

In the case of Hire Purchase, there will be no balloon payment here because the cost of the car is sewn into the finance amount you pay to the dealer.

If you want to take possession of the car after the end of the PCP contract, you will need to make a balloon payment. If you do not need the car, you do not have to pay the balloon payment and rent another vehicle right away.

Will I Automatically Own the Car at the End of the Agreement?

It is not always the case that ownership of the car is the ultimate goal of financing. It is also worth thinking about before choosing a suitable lending model.

In the case of HP - yes. As soon as you make the last payment, the car becomes your exclusive possession.

In the case of PCP, it's optional. Yes, you can take possession of the car by making a balloon payment, but you can also not do that - and then the vehicle will remain in the dealer's control.

Are There Any Other Options Open to Me at the End of the Plan?

Different options are also crucial for many people after the contract ends - let us see what possibilities await you.

Once the HP contract ends, the car is yours. After that, you are free to do whatever you want with it, such as keeping it, selling it, or trading it in.

When your PCP contract ends, you have three choices. The first is to trade the car for another. The second is to give the car back to the dealer. The third is to buy the car back for your own use.

Can I Settle Early?

Let us say your plans have changed and your financial situation has improved dramatically. In that case, you might want to close the deal sooner.

Yes, you can pay off the HP contract early at any time without any penalties.

You can also close the PCP deal early here, but not as quickly. You will most likely have to pay an estimated amount in addition to the final balloon payment. But of course, this is only if you want to buy the car.

Will There Be Any Extra Charges?

Finally, be sure to read the contract and talk to the dealer about any additional rental car costs you may have to pay.

There will be no extra costs for the HP agreement - just a monthly fixed payment at the same interest rate.

It is possible for PCP deal. For example, if you exceed the declared annual mileage, you will have to pay the penalty for the excess. You will also have to pay for damage unrelated to wear and tear separately.

So, what is better HP or PCP?

So, now that you know all the details of each deal, it is time to figure out which type is right for you. Depending on your goals, plans, and financial situation, the choice of financing will also be different. Let us break down which type of car finance is best for you.

Is PCP Right for Me?

The personal contract purchase scheme is suitable for you in several cases.

- You want to reduce your monthly car expenses - for example, you have a limited budget, or you just do not want to spend a lot of money on a car.

- You want a contract with a shorter term and more manageable payments - for example, you only want to drive the newest car makes and are going to change cars every 2-3 years.

- You are not interested in owning the car, but you need it for work - in which case, the PCP scheme is ideal.

Is HP Right for Me?

The HP finance scheme is also suitable for you in several cases.

- You need to own a car, but you are not ready to pay the total price for it right away - HP can help you spread the burden of paying off the cost of the car evenly.

- You want to improve your credit history - make your monthly payments regularly and in full, and your score will improve significantly.

Contents

- What is hire purchase?

- What is personal contract purchase?

- Comparing PCP and HP

- Will I need to pay a deposit?

- How much will I be borrowing?

- How much will my monthly repayments be?

- Can I adjust the finance plan duration?

- Will there be a balloon payment at the end of the agreement?

- Will I automatically own the car at the end of the agreement?

- Are there any other options open to me at the end of the plan?

- Can I settle early?

- Will there be any extra charges?

- Is HP right for me?

Latest News

| Loan amount: | £16,000 |

|---|---|

| Length of loan: | 60 months |

| Interest rate: | 12,9% |

| Amount of interest | £5,793.84 |

| Total payment: | £21,793.84 |