Today we are going to talk about one of the four vehicle categories, the S category. What does a category for written-off vehicles mean? In general, a category S vehicle is the one that has sustained structural damage. For example, it can be a vehicle with damage to the undercarriage resulting from an accident.

Cat S cars sell for 20-40% below market value. The discount attracts buyers, but the classification carries permanent consequences.

Category S marks vehicles with structural damage to the chassis, body shell, or crumple zones. Insurers write off these cars when repair costs reach 50-70% of their value. Professional garages can restore them, but the Cat S designation stays for life.

This affects insurance costs, financing options, and resale value. This guide explains what Cat S means, legal requirements, and essential checks before buying.

What is Cat S?

Cat S means the vehicle has suffered structural damage—but you can repair it and return it to the road. The "S" stands for "Structural."

Structural damage affects the car's core safety components: the chassis, body shell, crumple zones, or structural frame. This goes beyond surface-level panels. Insurers typically write off a car as Cat S when repair costs hit 50-70% of its market value. They make this decision based on economics, not because the car cannot be fixed.

You can buy and repair a Cat S car. A qualified engineer must inspect the vehicle after repairs to confirm it meets safety standards. You must then re-register it with the DVLA (Driver and Vehicle Licensing Agency). Your V5C logbook will permanently record the Category S status—this classification stays with the vehicle for life.

Cat S cars sell for 20-40% less than equivalent non-damaged vehicles. Factor in higher insurance costs, limited resale value, and the need for professional inspections before you buy.

Understanding structural damage in cat S cars

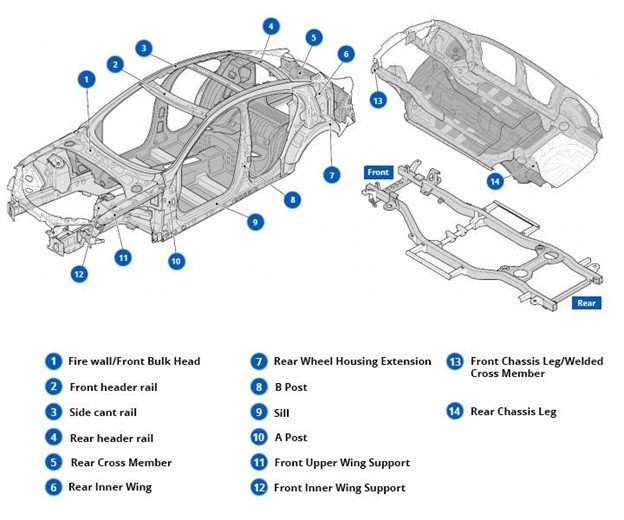

The structure of a car includes all parts that support its shape, absorb impact, and protect passengers. These structural components form the vehicle’s body shell, chassis (frame), crumple zones, and load-bearing pillars.

Damage to any of these parts counts as structural damage. Insurers consider such damage serious, even if external panels remain intact. This helps explain why a car with “hidden” frame or pillar damage might attract a Cat S write‑off. This distinction matters because bumpers, fenders, or headlights are mere cosmetic elements and do not impact the vehicle’s structural core.

The Association of British Insurers (ABI) uses these definitions in its salvage code, guiding how insurers categorise write‑offs. Structural damage places a vehicle in Category S, meaning it suffered serious but repairable damage.

What is the difference between cat s and cat n?

Cat S means the car has structural damage. Cat N means the car has non-structural damage.

Category S vehicles suffer damage to critical safety components: the chassis, structural frame, or body shell. These parts protect you during a crash. Insurers write off the car when repair costs outweigh its market value. A qualified engineer must inspect the vehicle after repairs. You must then re-register it with the DVLA. Your V5C logbook will record its Cat S status permanently.

Category N cars avoid structural damage. The problems affect electronics, suspension, airbags, or cosmetic body panels instead. Repairs cost less and take less time. You don't need to re-register the vehicle after repairs—though it must still meet roadworthy standards before you can drive it.

Both categories reduce resale value and increase insurance costs. Cat N cars prove easier to repair and insure. Cat S cars require thorough safety checks before they can return to the road.

What counts as roadworthy?

A car becomes roadworthy when it meets all legal standards required on UK roads and remains safe to drive. Roadworthiness covers UK construction, safety, environmental, and operating rules—not just MOT test requirements.

You must keep your car safe to drive at all times. A valid MOT certificate confirms the car met roadworthy standards at the test moment. The certificate does not guarantee ongoing safety throughout the year. You, the driver, must maintain that safety yourself.

Key elements that must work properly include:

- Brakes that stop effectively

- Tyres with at least 1.6mm of tread depth

- Lights, indicators, horn, windscreen wipers and mirrors in good condition

- No dangerous corrosion or structural damage

- Seat belts working correctly

- No oil or coolant leaks

- Clean, crack-free windows for clear visibility

Police and DVSA enforcement officers can stop your car and assess these safety features at any time.

Driving an unroadworthy car carries serious penalties. You face up to £2,500 in fines, three penalty points, and a potential driving ban. An unsafe car also invalidates your insurance and creates legal liability.

Find car finance deals for the best electric cars with the best rates!

My monthly budget is

Is cat S the same as cat C?

Category S replaced Cat C in October 2017. Both classifications mark structural damage that requires professional repair.

Insurers used Cat C before October 2017 to label cars with structural damage that cost more to repair than the vehicle's market value. The old system focused on repair economics. Cat C meant expensive structural repairs, while Cat D meant cheaper non-structural repairs.

The 2017 change shifted focus to damage type rather than cost. The new system prioritizes safety over economics. Cat S now covers any structural damage to the chassis, crumple zones, or frame—regardless of repair costs. Cat N replaced Cat D for non-structural damage.

You may still find Cat C and Cat D cars in listings. These vehicles were written off before 2017. Treat Cat C cars exactly like Cat S models: demand complete repair documentation, confirm DVLA re-registration, and arrange independent structural inspections before purchase.

What are the other categories for insurance write-offs?

After an analysis conducted by the ABI (Association of British Insurers), four insurance categories were defined in 2017 – namely, categories A, B, S and category N. Let us take a closer look at each of them and highlight their main differences.

| CAT A | Cars with very serious damage. The components that give a vehicle its strength may have been heavily damaged or worn out. Whatever is left of the car is scrapped and destroyed. |

| CAT B | The second most severe level of damage to the vehicle. Only the chassis and body shell must be scrapped. The remains of such a car can be stripped for salvage and used on other vehicles. |

| CAT S | Decommissioned vehicles that have structural damage to the structural frame or chassis that can be repaired and put back to use again. However, the vehicle must pass a mechanical inspection by an accredited engineer and be re-registered with the DVLA (Driver and Vehicle Licensing Agency). |

| CAT N | Vehicles that have received non-serious and non-structural damage. They can be repaired and returned to service. A cat N vehicle does not need to be inspected or re-registered before being returned to the road. |

Who repairs category S cars?

Specialist garages with structural repair equipment handle Cat S cars. These vehicles need repairs to the chassis, body shell, or structural frame. Basic body shops lack the necessary tools and expertise. Most Cat S vehicles go to independent workshops or salvage repair centres that specialize in structural work.

A qualified engineer must inspect the car once repairs finish. The industry calls these professionals Appropriately Qualified Persons (AQPs). They examine the repairs and confirm the vehicle meets safety standards. You must then re-register the vehicle with the DVLA. Your new V5C logbook will record the Cat S write-off permanently.

Always arrange an independent inspection before you purchase a repaired Cat S vehicle. Request the engineer's report and MOT certificate. Run a full HPI check to verify the car's history and identify any outstanding finance. Never rely on seller claims alone—verify everything independently.

Legal and regulatory aspects of category S cars

Dealing with the DVLA

You must notify the DVLA when your insurer writes off your car under Category S. Use the online DVLA service or post the yellow V5C trade slip to report the write-off. You need the vehicle's registration number, the 11-digit V5C reference, and the name and postcode of the insurer or salvage agent.

The DVLA sends confirmation once you complete this process. The confirmation shows you are no longer the registered keeper. You receive a tax refund for any unused full months.

Applying for a New V5C

Your insurer must submit Form V23 to notify the DVLA immediately after they categorize the vehicle as Cat S. You (the keeper) still carry the legal duty to ensure the DVLA receives the write-off notice.

The insurer owns the vehicle initially if you keep it. You must send your original V5C to them. You then apply for a duplicate V5C using Form V62. The DVLA issues a new logbook that permanently records the Category S status. This classification cannot be removed.

Failing to notify the DVLA triggers penalties up to £1,000 in fines. You remain liable for road tax and any legal issues involving the car until you complete the notification.

Dealing with insurers

Every car needs insurance. Cat S vehicles create extra challenges. You must declare the Cat S status when you apply for coverage.

Can I insure a category S car?

Yes, but not all insurers will cover you. Some refuse Cat S vehicles outright. Others charge significantly higher premiums. Specialist insurers and brokers typically offer better terms because they understand the risks and provide tailored policies for written-off vehicles.

You need professional structural repairs backed by an engineer's report or photographs. Obtain a valid MOT certificate to prove the vehicle meets roadworthy standards. Run an HPI check before you purchase—this confirms the write-off history, outstanding finance, and other red flags.

Get insurance quotes before you commit to buying a Cat S vehicle. This reveals the true long-term costs of ownership.

Will I have to pay more for a cat S car insurance?

Cat S premiums typically run 15-20% higher than equivalent non-damaged vehicles. One comparison shows average Cat S premiums of £506 versus £431 for clean cars—a 17% increase.

Insurers view previously repaired vehicles as higher risk. The repair quality varies significantly between garages. The vehicle's value after a second write-off creates uncertainty. These factors drive up premiums across the board.

Failing to declare Cat S status invalidates your policy. The insurer can refuse claims and potentially pursue fraud allegations. Always disclose the write-off status upfront.

Can I drive a cat S car knowing it is safe?

Yes, you can drive a Cat S car after you complete proper repairs, inspections, and legal requirements.

You must repair all structural damage to professional standards. A qualified engineer must inspect the completed work. You then need a fresh MOT test to confirm the vehicle meets roadworthy standards.

You must re-register the vehicle with the DVLA before you drive it. The DVLA issues an updated V5C logbook that records the Cat S status permanently. Once the car passes inspection and the MOT test, and you obtain appropriate insurance, the vehicle becomes legal to drive.

The car remains safe only if the repairs hold and you maintain it properly. Your ongoing responsibility includes regular servicing and immediate attention to any mechanical issues.

Can I finance a Cat S car?

You've found a Cat S car at an attractive price and want to spread the cost over monthly payments. This is where many buyers hit an unexpected wall. Financing a Cat S car creates significant challenges compared to standard vehicles. Most traditional lenders and high-street banks refuse Cat S applications outright.

Read more on the topic - What happens if my car is written off and it's on finance?

Why lenders avoid Cat S vehicles

Lenders assess Cat S cars as high-risk investments for several reasons. The structural damage history raises concerns about long-term reliability and safety. Resale value drops by 20-40% compared to clean-title equivalents, which directly impacts the lender's position. If they need to repossess the vehicle for non-payment, they recover substantially less money than anticipated.

The buyer pool shrinks considerably for Cat S vehicles. Fewer people want to purchase them, which means lenders face longer selling times and lower auction prices. This compounds their risk exposure. Additionally, repair quality varies dramatically between garages, creating uncertainty about the vehicle's mechanical condition over the loan term.

As a result, major high-street banks and mainstream car finance companies typically reject Cat S applications automatically. Their standard lending criteria exclude vehicles with structural damage classifications.

Is it worth buying a category S vehicle?

So, you decided to buy a car from category S. Here is what you need to know before buying, plus all the details you should pay attention to.

When should I buy a cat S?

You save 20-40% on the purchase price compared to equivalent undamaged models. This discount appeals to buyers who plan long-term ownership and accept higher running costs.

Cat S vehicles work best when you:

- Know the vehicle's complete history

- Trust the repair quality (verified by independent inspection)

- Plan to keep the car for 5+ years

- Pay cash rather than finance

- Accept 15-20% higher insurance premiums

- Don't rely on strong resale value

Run a complete cost-benefit analysis before you commit. Factor in:

- Repair costs (if not yet completed)

- Insurance quotes from multiple providers

- Future resale value (typically 20-40% below market)

- Financing challenges (many lenders refuse Cat S vehicles)

Compare the total 5-year ownership cost against a clean-title alternative. The headline discount often shrinks significantly once you add higher insurance, limited resale value, and financing difficulties.

Order an HPI report to confirm write-off status, damage history, and outstanding finance. Arrange a professional inspection by a qualified engineer—particularly critical for already-repaired vehicles. The engineer must verify the structural frame, chassis, and crumple zones meet safety standards.

Get insurance quotes before you purchase. Some insurers refuse Cat S vehicles entirely. Others charge premiums 15-20% above standard rates.

Once the car passes inspection, obtains a valid MOT, and you re-register it with the DVLA, you can insure and drive it legally. You must disclose the Cat S status to insurers immediately and to all future buyers when you sell.

How do I check if the car was in category S?

Always verify Cat S status using both official registration records and trusted vehicle history services. Car dealerships must disclose the car's S-category classification by law—concealing this information breaks UK consumer protection rules.

Start with the V5C log book.

The DVLA marks Cat S status on the V5C if the owner properly reported the write-off after repairs. Never rely on verbal assurances alone. Request to see the physical V5C document.

Use a paid vehicle-history check.

Enter the registration number (VRM) into a service such as HPI, CarAnalytics, or Total Car Check. These reports access the MIAFTR (Motor Insurance Anti-Fraud and Theft Register) database and reveal:

- Insurance write-off category (including Cat S)

- Salvage history from insurance industry datasets

- Outstanding finance or theft records

- Mileage discrepancies

- Complete MOT history

These paid checks cost £5-20 and provide information unavailable through free DVLA services.

Carry out a DVLA vehicle enquiry.

Visit the DVLA website and enter the registration number. This confirms the vehicle's make, model, registration details, and MOT status. Note: The free DVLA service does not show write-off status—you need paid checks for this.

Watch for VIC markers.

Some pre-2015 write-offs carry a VIC (Vehicle Identity Check) mark on the V5C. This indicated a prior inspection under the old VIC scheme, which ended in 2015. The VIC scheme verified vehicle identity, not safety standards. HPI reports may flag these historical VIC records.

Be extra cautious with private sellers.

Private sellers may genuinely not know the vehicle's complete history. Some sellers deliberately conceal write-off status. Always run an HPI check before you hand over any money—even a deposit.

Does buying a cat S car require a license?

No, it is not necessary. The process of buying a car doesn’t require a license. Of course, you will need it to drive the vehicle.

Do I need a vic check for my cat S car?

The Vehicle Identity Check (VIC) scheme in the UK was abolished in 2015. So, you don’t have to go through it when buying your car. But if you want your car back in use after damage, you can apply for a replacement V5 registration book from the DVLA.

Legal requirements after buying a Cat S car

You must re-register a Cat S car, pass a fresh MOT, notify the DVLA, and obtain insurance before you can legally drive it.

Apply for a new V5C logbook using Form V62 after you purchase a Cat S vehicle. The insurer typically retains the original V5C when they write off the car, so the vehicle won't include this document at sale. The DVLA issues a new logbook that permanently records the structural damage. This designation cannot be removed.

Book an MOT test to confirm the vehicle meets roadworthy standards. This step is mandatory. You cannot tax the car or drive it on public roads without a valid MOT certificate. Ensure a qualified professional completes all structural repairs before you book the test. The MOT examiner will fail the vehicle if they identify substandard repair work.

You must also tell the DVLA that you’re keeping a written-off vehicle. This is a legal requirement. Failing to do so can result in a fine of up to £1,000. You can report this online through the GOV.UK website.

Contact your insurer immediately to declare the Cat S status. They will request evidence: repair documentation, MOT certificate, and photographs of the restored vehicle. Some insurers charge 15-20% higher premiums for Cat S vehicles. Others refuse coverage entirely if you don't disclose the damage history upfront. Failing to declare the status invalidates your policy.

You can tax and drive the car once you complete all four steps: re-registration, MOT, DVLA notification, and insurance. Keep all documents related to repairs, assessments, and registration. These records protect you during resale, support future insurance claims, and prove the vehicle meets legal and safety standards.

Selling a cat S vehicle

Selling a Cat S car is legal in the UK. You must disclose the Cat S status to all potential buyers before sale. UK consumer protection law requires this transparency.

Is selling a cat S car legal?

Yes. You can legally sell a Cat S or Cat N vehicle. You must declare the write-off status to every potential buyer before they commit to purchase. This requirement applies even after professional repairs—the Cat S designation remains with the vehicle permanently and cannot be removed.

Failing to disclose Cat S status breaks UK consumer protection law. Buyers can sue you for damages, demand refunds, or report you for fraud. The law protects buyers and ensures transparency in the used car market.

What resale value can I expect?

Cat S vehicles typically sell for 20-40% below equivalent clean-title cars. The exact discount depends on:

- Vehicle age and model

- Quality and documentation of repairs

- Current market demand

- Availability of competing clean-title vehicles

Expect a smaller buyer pool. Many buyers avoid Cat S vehicles entirely due to insurance costs, financing difficulties, and future resale challenges.

Who will buy my cat S vehicle?

Salvage buyers purchase unrepaired damaged Cat S cars for parts. They strip the vehicle and resell components to repair shops and individual buyers.

Private buyers, mechanics, and car enthusiasts purchase professionally repaired Cat S vehicles. These buyers seek value and accept the trade-offs: higher insurance costs, limited financing options, and lower future resale value.

Specialist dealers handle Cat S vehicles. They understand the market and have established buyer networks. Dealers typically offer less than private sale prices but provide faster, easier transactions.

Final words

Buying or owning a Category S car can be a smart way to save money, but it comes with added responsibility. From checking the vehicle’s repair history to ensuring DVLA re-registration and arranging appropriate insurance, every step matters. While these cars are legal and safe to drive once properly repaired, you must do your due diligence.

Always inspect the vehicle thoroughly, confirm its status with an HPI check, and understand the long-term costs, including insurance and resale value. If you’re confident in the car’s condition and you plan to keep it for a while, a Cat S car can be a practical and budget-friendly option.

But don’t cut corners. Safety, transparency, and proper paperwork are essential, for your peace of mind and for anyone who may drive or buy the car in the future.

Table of Contents