Car financing has become the most popular way to buy a vehicle - and it does not matter if it is new or used. Small monthly payments attract far more people than the option of paying a large sum at once for something that will probably need to be replaced or repaired in a couple of years.

But how do you choose the right type of finance among the dozens of options available? Today, let us talk about two of the most popular types of vehicle finance - the personal contract purchase (PCP) and the hire purchase agreement (HP).

What is Hire Purchase?

Hire Purchase splits a car's full cost into monthly instalments. You borrow money from a lender to cover the vehicle's price minus your deposit, which means the finance lender owns the car until you complete your final payment.

You start by paying a deposit at the beginning of your finance agreement. Your monthly payments, then cover the remaining balance plus interest over your contract term, typically 12 to 60 months. Once you've made every monthly payment and paid the option to purchase fee you become the legal owner.

Key HP benefits

- Guaranteed ownership at the end of your contract term

- No mileage limits or wear and tear restrictions

- No excess mileage charges or damage charges

- Works for both new cars and used cars

- Regular payments improve your credit score

Important HP considerations

- Higher monthly payments than PCP because you repay the car's full value

- Suits borrowers keeping vehicles long-term

- Longer contract terms increase total annual percentage rate charges

What is Personal Contract Purchase?

Personal Contract Purchase covers a car's depreciation rather than its full value. You borrow the difference between the vehicle's current price and its Guaranteed Minimum Future Value at contract end. This approach reduces your monthly payments because you're financing less of the car's total cost.

The Guaranteed Minimum Future Value forms the foundation of every PCP agreement. Your finance lender calculates this figure based on the car's expected value after your contract term, typically 24 to 60 months. You pay a deposit upfront, then your monthly payments cover the depreciation plus interest. The lender assumes the risk if the car loses more value than predicted.

You don't own the vehicle when your PCP contract ends. You face a choice at this point. Pay the balloon payment to own the car, return it to the finance lender with nothing more to pay, or trade it for a different vehicle on a new agreement. This flexibility distinguishes PCP from Hire Purchase.

Key PCP benefits

- Lower monthly payments than HP because you defer the balloon payment

- Protection from depreciation risk through the guaranteed minimum future value

- Flexibility to return, buy, or trade the vehicle at contract end

- Regular access to newer car models every few years

- Option to refinance the balloon payment if you decide to keep the vehicle

Important PCP considerations

- Mileage limits apply with excess charges for additional miles driven

- Damage charges may apply beyond fair wear and tear standards

- Large balloon payment required if you decide to own the vehicle

- PCP agreements typically available on newer cars only

- You don't build equity during the contract term unless the car's value exceeds the guaranteed minimum future value

Examples of PCP & HP Agreements

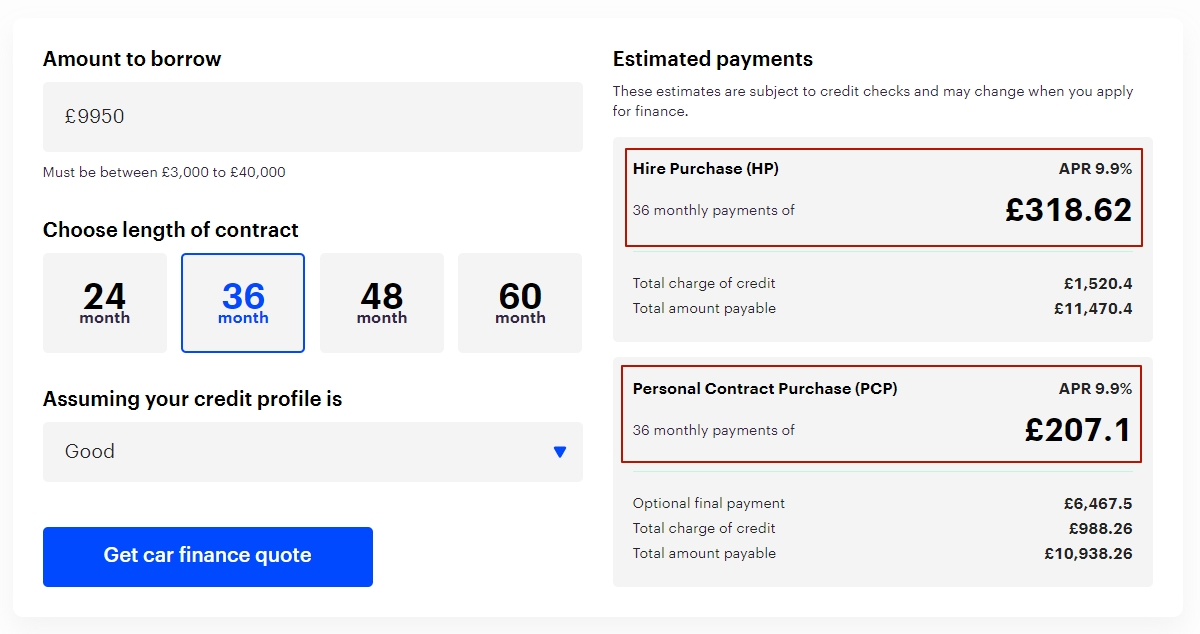

Ford Focus1L Zetec EcoBoost T - Good Credit and 36 months

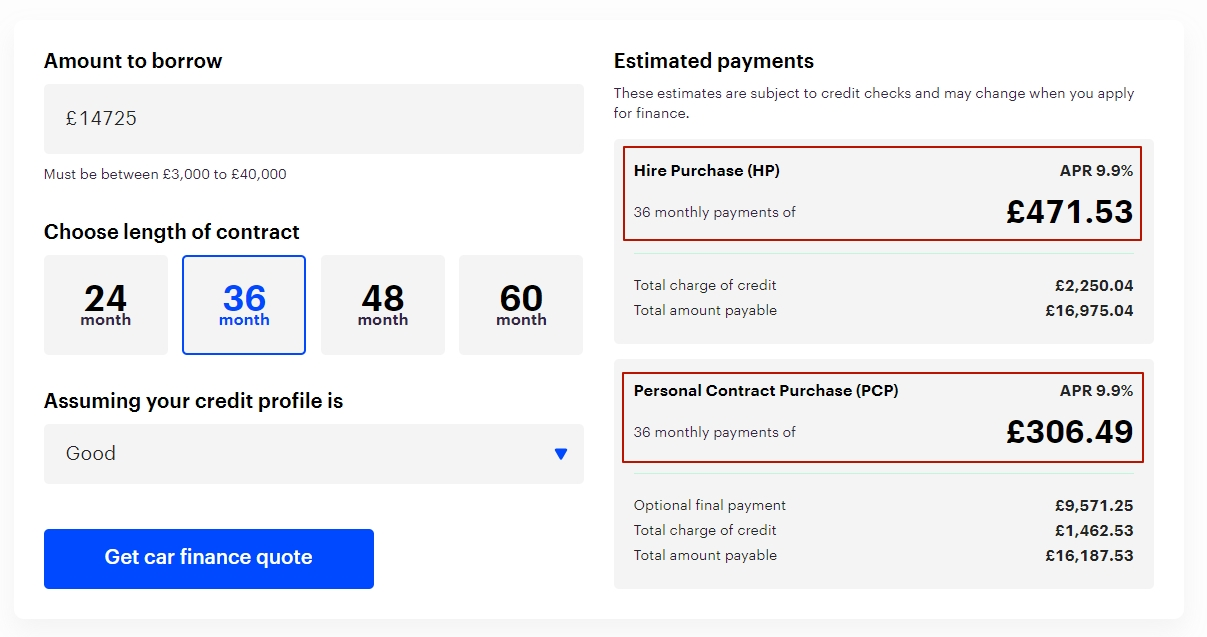

BMW 1 Series 1.5L SE Business 116d - Good Credit and 36 months

Core differences: PCP vs HP

To make it easier for you to decide on the type of financing, we have thoroughly compared PCP and HP and created a table that shows the pros and cons of each type of car finance.

| Feature | Hire Purchase | Personal Contract Purchase |

|---|---|---|

| Extra charges | No | Yes |

| Early settlement | Yes | Yes |

| Damage and excess wear | No | Yes |

| Low monthly payments | Optional | Yes |

| Mileage restrictions | No | Yes |

| Final car ownership | Yes | Optional |

| Deposit | Yes | Yes |

| Adjust finance plans | Yes | Yes |

| Balloon payment | No | Yes |

Ownership timeline

Hire Purchase delivers guaranteed ownership from the start of your agreement. You pay the car's full value through your monthly instalments plus interest. Once you complete your final payment, you own the vehicle outright with no additional fees.

Personal Contract Purchase defers your ownership decision until the contract ends. You don't automatically own the car after your final monthly payment. But you must pay the balloon payment to take ownership, return the vehicle, or trade it for a different model.

Payment structure

Hire Purchase divides the car's full value across your monthly instalments. You repay the entire purchase price plus interest over your contract term. Your monthly payments stay fixed throughout the agreement.

But Personal Contract Purchase splits only the depreciation into monthly instalments. You defer the car's residual value to a final balloon payment. This structure reduces your monthly cost significantly compared to Hire Purchase.

And the interest calculation differs too. Hire Purchase charges interest on the declining balance as you repay. PCP charges interest on the full car value throughout the term, which increases your total borrowing cost.

End-of-term flexibility

Hire Purchase delivers automatic ownership. You complete your final payment and the car becomes yours. No choices to make. No additional fees to consider.

But Personal Contract Purchase offers three distinct paths. You choose what happens when your contract ends. This flexibility defines PCP's appeal.

Your first option: pay the balloon payment and own the car outright. Your second option: return the vehicle to the finance lender with nothing more to pay, subject to mileage and condition terms. Or your third option: trade the car for a different vehicle and start a new agreement.

Risk distribution

Hire Purchase places full depreciation risk on you. You own the car throughout your agreement and absorb any value loss. Market conditions don't matter. The car's future worth becomes your responsibility.

But Personal Contract Purchase transfers this risk to your finance lender. The guaranteed minimum future value protects you from unexpected depreciation. Your lender sets this figure at the start and guarantees it throughout your contract.

And this guarantee delivers real protection. If your car's actual value drops below the guaranteed amount, your lender absorbs the difference. You simply return the vehicle with nothing more to pay, regardless of market conditions.

Do I need a deposit?

Your deposit directly affects your monthly payments. A larger deposit reduces the amount you borrow and lowers your monthly cost. A smaller deposit increases both.

Most finance lenders require a deposit of around 10% of the car's value. This applies to both Hire Purchase and Personal Contract Purchase agreements. Some lenders offer zero-deposit options, though your monthly payments will be significantly higher.

You control this balance. Pay more upfront and enjoy lower monthly commitments. Or pay nothing upfront and accept the higher monthly burden.

How much will I borrow?

Hire Purchase finances the car's full value minus your deposit. You borrow the entire purchase price and repay it with interest. Your borrowing amount covers every pound of the vehicle's cost.

But Personal Contract Purchase finances only the depreciation. You borrow the difference between the car's current value and its guaranteed minimum future value, minus your deposit. This significantly reduces your borrowing amount compared to Hire Purchase.

And the balloon payment sits outside your borrowing. You either pay this final amount separately, return the car, or trade it for another vehicle.

How much are the monthly payments?

Hire Purchase requires higher monthly payments. You're repaying the car's full value across your contract term. Your monthly cost reflects this complete repayment structure.

But Personal Contract Purchase delivers significantly lower monthly payments. You're financing only the depreciation, not the entire vehicle value. This reduces your monthly commitment by hundreds of pounds compared to Hire Purchase.

Will there be a balloon payment at the end of the agreement?

Hire Purchase includes no balloon payment. You repay the car's entire value through your monthly instalments, spreading the full cost across your contract term. Once you complete your final monthly payment and pay a small option to purchase fee, the car becomes yours.

But Personal Contract Purchase defers a large portion of the cost to the end. You face a substantial balloon payment matching the car's guaranteed minimum future value if you want ownership. Pay this final sum and the car becomes yours, or simply return the vehicle with nothing more to pay.

Are there any extra charges?

Hire Purchase charges nothing beyond your fixed monthly payments and interest. You drive without usage restrictions or condition requirements. No penalties apply regardless of mileage or vehicle condition.

But Personal Contract Purchase includes potential additional charges. Exceed your agreed annual mileage and you face excess mileage charges, typically ranging from 5p to 30p per mile. Damage beyond fair wear and tear standards triggers separate repair charges when you return the vehicle.

Are there mileage limits?

Hire Purchase imposes no mileage restrictions whatsoever. This means you drive as much as you need without facing penalties or monitoring. Your usage patterns remain entirely your own business throughout the contract and beyond.

Personal Contract Purchase works differently. It requires annual mileage limits because your driving directly affects the car's future value. Your finance lender sets this limit at the contract start, typically between 8,000 and 15,000 miles per year. This restriction protects the vehicle's residual value, which in turn determines your guaranteed minimum future value.

Exceeding your agreed limit triggers excess mileage charges when you return the vehicle. These penalties typically range from 5p to 30p per mile. As a result, a thousand excess miles could cost you £50 to £300. Push beyond by ten thousand miles and the charges escalate into the thousands of pounds.

What happens if I damage the car?

Hire Purchase makes damage your personal responsibility from day one. This means you own any consequences of wear, tear, or accidental damage throughout your contract. No finance lender assesses the vehicle's condition because you're buying it regardless of its state.

But Personal Contract Purchase operates under fair wear and tear standards if you return the vehicle. These standards follow British Vehicle Rental and Leasing Association guidelines, which define acceptable deterioration. Small scratches up to 25mm remain acceptable, as do minor paintwork chips and light window scratches outside the driver's sight line.

Exceed these standards and you face damage charges when returning the car. Typical penalties include £50 or more for alloy wheel scuffs, over £100 for dented bumpers, and £20 upwards for windscreen chips. However, these charges disappear entirely if you pay the balloon payment and keep the vehicle, because it becomes yours.

Can I adjust the contract length?

Both Hire Purchase and Personal Contract Purchase let you choose your contract length when setting up your agreement. This initial choice significantly affects your monthly payment size and total interest cost.

Hire Purchase offers contract terms from 12 to 60 months, giving you a wide range to match your budget. Longer terms spread the full vehicle cost over more months, reducing your monthly commitment but increasing your total interest charges. This flexibility helps you balance immediate affordability against long-term cost.

Personal Contract Purchase typically runs for 24 to 48 months, occasionally extending to 60 months. These shorter terms reflect the product's design for drivers who change vehicles regularly. The narrower range means less flexibility than Hire Purchase, though you still control the monthly payment size through your chosen duration.

Once you've started your agreement, changing the contract length becomes difficult. Your finance lender sets the term at the outset, and it generally remains fixed throughout. However, early settlement remains an option if your circumstances improve, allowing you to pay off the agreement ahead of schedule.

Who owns the car at the end?

Hire Purchase delivers automatic ownership once you complete your final payment. You pay a small option to purchase fee, typically around £50, and legal ownership transfers to your name. The finance lender owns the vehicle throughout your agreement, but ownership passes to you automatically without requiring any further decisions.

But Personal Contract Purchase leaves ownership entirely optional. The finance lender retains legal ownership after your final monthly payment. You must actively pay the balloon payment to own the car, or simply return the vehicle and walk away.

What are my end-of-term options?

Hire Purchase delivers one outcome. You complete your final payment and the car becomes yours.

But Personal Contract Purchase offers three distinct paths at the end of a contract. Your first option pays the balloon payment to own the car, typically several thousand pounds matching your guaranteed minimum future value. Or you return the vehicle with nothing more to pay, provided you've met mileage limits and fair wear and tear standards.

Your third option trades the car for a new vehicle. This works when your car's actual value exceeds its guaranteed minimum future value, creating positive equity you can apply as deposit. But if the value falls short, you'll need to cover the negative equity difference yourself or roll it into your new agreement. Your dealer handles the entire transaction, settling your balloon payment whilst starting your new agreement.

Can I end my agreement early?

Both Hire Purchase and Personal Contract Purchase offer early endings through two routes. You can request an early settlement figure from your lender, pay it, and own the car outright. Or you can use voluntary termination to return the vehicle once you've paid 50% of the total amount payable, including any balloon payment. This 50% threshold arrives around mid-contract for Hire Purchase but much later for Personal Contract Purchase. Your car must meet mileage limits and fair wear and tear standards, otherwise you'll face additional charges.

So, what is better for me: HP or PCP?

Is HP right for me?

Hire Purchase suits you if you plan to keep your car long-term and want guaranteed ownership. This product works brilliantly when you drive high mileage, because it imposes no usage restrictions or excess mileage penalties. And you'll need to manage higher monthly payments compared to Personal Contract Purchase, since you're repaying the vehicle's full value throughout your agreement.

But this simplicity delivers clear benefits. You avoid the complexity of large balloon payments or end-of-term decisions, building equity in your vehicle from day one. This means Hire Purchase works best when you value straightforward ownership over flexibility.

Is PCP right for me?

Personal Contract Purchase suits you if you want lower monthly payments and aren't certain about keeping your car long-term. This flexibility lets you choose between ownership, returning the vehicle, or trading for something newer when your agreement ends. And you'll particularly benefit if you enjoy driving newer cars every few years without handling private sales yourself.

But this product requires predictable driving patterns. You must stay within agreed annual mileage limits, typically between 8,000 and 15,000 miles, and maintain the vehicle to fair wear and tear standards. Or you'll face additional charges when returning it.

Table of Contents

- Ownership timeline

- Payment structure

- End-of-term flexibility

- Risk distribution

- Do I need a deposit?

- How much will I borrow?

- How much are the monthly payments?

- Will there be a balloon payment at the end of the agreement?

- Are there any extra charges?

- Are there mileage limits?

- What happens if I damage the car?

- Can I adjust the contract length?

- Who owns the car at the end?

- What are my end-of-term options?

- Can I end my agreement early?