Roman Danaev

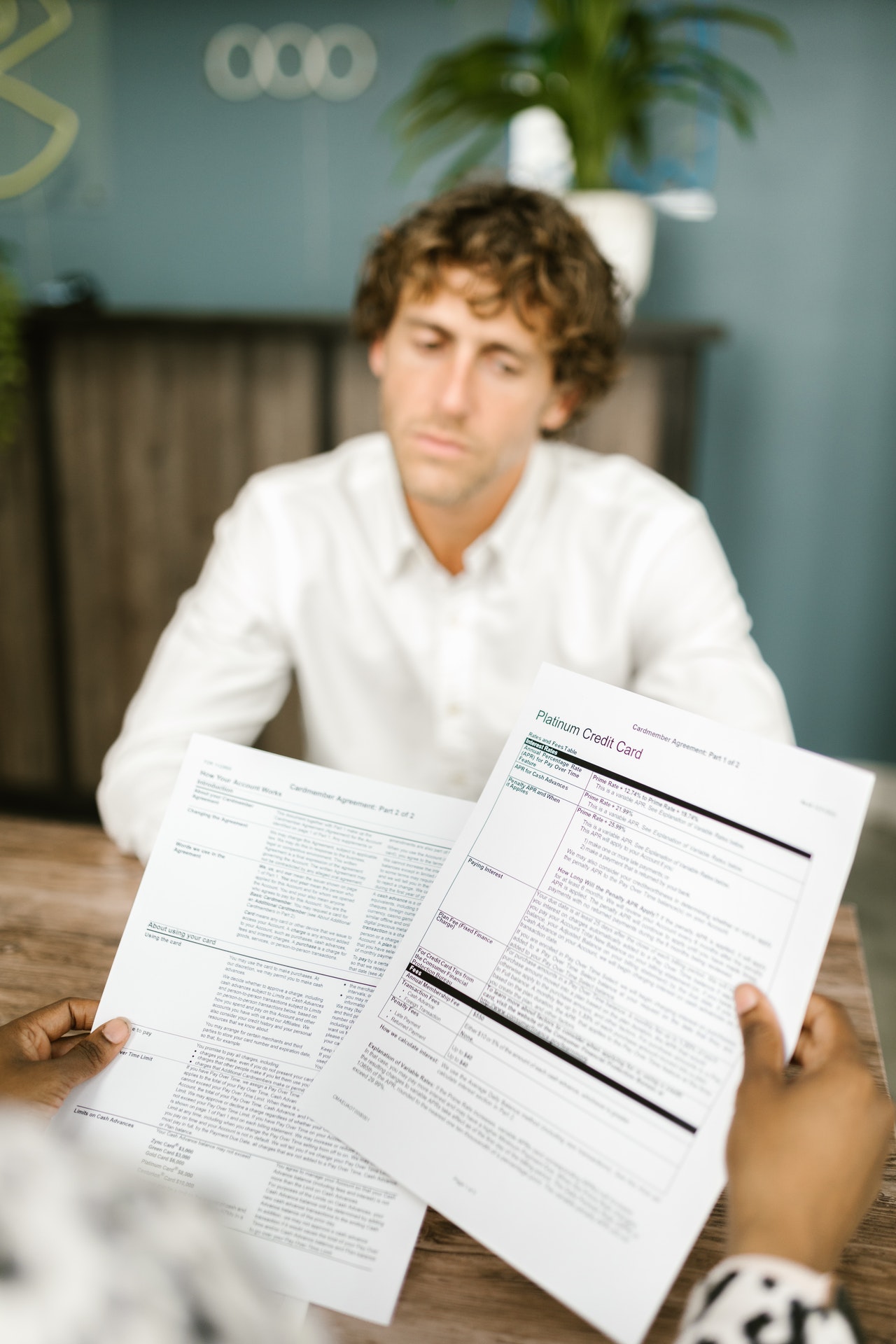

Choosing Hire Purchase finance has the advantage of making it realistic to afford better cars. But the benefits don't stop there - this article will highlight them all. To show you the complete picture, we'll also discuss this finance deal's disadvantages.

In the end, we'll briefly compare Hire Purchase with other types of car finance.

What is hire purchase (HP)?

Hire Purchase is a popular finance agreement to buy new and used cars. Such a contract usually requires you to make a deposit (although not always) and make regular payments over the contract period.

HP agreements last 12 to 60 months (one to five years). The monthly instalments will be adjusted up or down depending on the period. What also lowers or increases your monthly payments is the size of the deposit you put down.

Until you make the final instalment, you're not considered a legal owner of the car. While the HP contract is still active, the finance company owns the car. So, you can't sell the vehicle or make significant changes without the permission of the broker (or the manufacturer).

Pros and cons of HP finance option

Now, let's move on to the main part of the article! First, take a look at the table of pros and cons.

| Advantages of Hire Purchase | Disadvantages of Hire Purchase |

|---|---|

|

|

Advantages

Having listed the advantages, we'll now explore them in more detail.

1. Spreads the cost into monthly payments

Most people don't have a lump sum of cash available to pay for a car outright. Even if they do, it's reasonable to want to keep their savings for an emergency. Hire Purchase solves this problem by spreading a large payment into more manageable pieces.

This way, you make a car purchase much more affordable. You don't have to settle for a cheaper option to make the purchase fit your budget. For some, spread-out payments make the difference between having a car on finance and not having one at all.

2. Newer, higher-spec cars

Hire Purchase finance will make a higher specification car more affordable. So, suppose you do have some savings to buy a car. What would be out of your budget without finance will now be within your reach.

You will be less limited in your choices. Mind you, it's not only about prestige and comfort but also about your practical needs. A higher-spec car is not just flashy; it offers the tech and functionality you need in your day-to-day life.

3. Fixed payment schedule

With some other forms of borrowing, the payments may fluctuate based on interest rates and other factors. But not here.

You will be confident that the monthly payment amount specified in the contract will stay the same throughout the term. This will allow you to plan your financial matter, always keeping in mind that fixed expense each month. The interest rate will also be locked, so there will be no surprises on that front.

4. Option to adjust the repayment amount

Another good thing about getting a car on Hire Purchase is the flexibility in its repayment terms. There are a few ways to reduce the amount your pay monthly. Of course, those who can afford a higher amount can also increase it.

You can pay a bigger deposit when concluding the contract. This will instantly lower the required instalments. Alternatively, you can extend your repayment term to spread out the costs even more! Choose to repay the same amount over one to five years - whatever suits you best.

5. Tax efficiency

Finance companies usually include taxes in the overall agreement, reducing long-term add-on costs.

If you're buying for a business, it becomes even more beneficial. When you finance a car for business, you can get tax relief through capital allowances. Here is what it means: you are allowed to deduct some or all of the vehicle's value from your profits. You'll only pay the tax after the deduction.

How much you can deduct depends on the car and its CO2 emissions. CO2 emissions above 110g/km get you 6% off; CO2 emissions under 50g/km can get you a 15%; CO2 emissions are 50g/km for the first year.

6. Fewer conditional restrictions

Financing agreements where you must return the car to the dealership by the end have the agreed mileage or conditional restrictions. So, every time you go on a long or aggressive drive, you may have this worry at the back of your head - that you'll exceed the restrictions and be fined.

With Hire Purchase, the restrictions are much more relaxed. You can drive however many miles you want using the car as your own. However, make sure to read (or re-read) your agreement before making significant modifications. There might be stipulations from the broker that you can't break - not as many as with many other car credit deals.

7. Can be paid off early

If you start making more money after a while or sell something at a good profit, you may not want to owe your finance company. Most HP agreements will have a condition that will allow you to settle early. You will likely be allowed to repay the total amount only after a certain number of months.

You may also be interested to read - Can you pay off car finance early?

8. Suitable for people with bad credit

There is no shame in going through a rough patch financially. And even after you figure your situation out, the credit score may take too long to recover. While it does, you don't have to deny yourself the necessity that a car.

Hire Purchase is the easiest type of car finance to get approved for. People struggling with bad credit shouldn't worry as much about credit checks, which are not as strict as bank loans. Looking at the rate of approval for HP is always good news. Carplus offers bad credit car finance for people with poor and low credit scores and helps them to get the car they want!

9. May not require a down payment

If you have excellent credit, you can enjoy Hire Purchase's other perk - no down payment. Those who can prove themselves as reliable borrowers can start making monthly payments right away without having to save up large amounts of money.

Remember that a zero-deposit car finance option will carry a more extensive monthly instalment. But if you'd rather keep your savings or use them for something more urgent, you're free to do so.

10. Car ownership at the end of the contract

After you send your last monthly instalment, the finance company will no longer be the legal owner. The car ownership will automatically be transferred to you. From that point on, you can sell the car or do any modifications you want. No need to make the balloon payment, which is usually much higher than the regular monthly payment.

You have the option to part-exchange the car on finance for a newer one. However, HP is more cost-efficient for those who keep the car.

Disadvantages

Here are the disadvantages of Hire Purchase to consider.

1. No ownership before the end of the contract term

Hire Purchase finance implies using the car to secure the money borrowed. While you have immediate access to the car, you don't get the privileges of owning it. The lender will own the vehicle until the loan is repaid. That is what the "hiring" part in the name means,

If you fail to make the payments in time, the car can be easily taken away and repossessed. So, you're exposing yourself to risk - you may suddenly end up without a car and have no equity.

2. More expensive than buying

With all the conveniences of getting the car instantly and not needing to pay the entire car price upfront comes this drawback. If you can't pay for the car in full upfront, you'll have to pay more in total. In addition to paying for the car's value, you'll also have to cover the interest.

A quick tip: with a shorter payment term, you'll end up paying less.

The interest rates range from a vendor to vendor, and the interest you pay will depend on your circumstances. But the extra cost assured by interest should always be one of the key considerations.

3. Lower credit score = higher interest rates

As mentioned in the previous point, lenders charge different amounts of interest depending on who's borrowing. You might also remember that credit checks are less strict than with other loans. However, a bad credit rating can take a toll on your budget.

Those who have been unfortunate enough to get a poor credit score will pay more than those who kept it high. Those who haven't borrowed in the past and have no credit history will also receive a less cost-effective offer.

Considering the lifetime of a Hire Purchase agreement, a higher interest rate can result in thousands extra.

4. Late payments = damage to the credit score

The progress of your repayments is sent to the major credit reporting agencies. If you do poorly, your credit score will be affected by it.

The report of missed payments stays in your file for six years. Any future lender will be able to look it up and change their decision based on the findings. For those with a good rating, late payments may mean getting worse interest for future loans. For those with bad credit, it may mean not getting approved for future loans at all.

5. Impractical as a very short-term agreement

Hire Purchase doesn't work as a very short-term agreement. It would be impractical and expensive to take out this type of finance for less than a year. If you suppose that you'll be able to repay the value of the car within a year (and you prefer to do so), consider another form of borrowing.

Is hire purchase better than other car finance options?

If you're eager to get a good car finance deal, but HP doesn't seem like the right fit, you have alternatives.

Personal contract purchase (PCP)

With PCP finance, you only cover the value that the car is expected to lose by the end of the contract. This is called the guaranteed minimum future value (GMFV), and this amount is split into monthly instalments over the contract period.

Because the total costs are lower than HP, PCP makes the prospect of financing a car much more manageable. However, you don't automatically own the car at the end of the PCP agreement. You'll have to make the balloon payment.

For an in-depth comparison between the two finance options, check out our article PCP vs HP.

Personal loan

The main difference between a personal loan and HP is that one can be used for many different purposes, and the other is strictly for a vehicle.

Both are structured similarly - with monthly instalments and interest. But banks make it harder to take out a personal loan than finance companies do for HP, especially if you don't have an excellent credit score.

Another difference that makes Hire Purchase more optimal for prospective car owners is that dealer-financed auto loans carry a lower interest rate.

Leasing

Like with PCP, leasing requires smaller monthly instalments that cover the depreciation of the car. But at the end of the contract, you have to make the lump sum payment and buy the car; you can't opt out of it.

So, while leasing seems like a more affordable option for the majority of the contract length, the final payment may be overwhelming. Some prefer the costs to be evenly spread out.

Other differences are covered in our article on Hire Purchase vs Lease.

So, in some aspects, HP is better than other credit options. But it ultimately depends on what you're after - ownership, affordability, flexibility, ability to switch cars, or something else.

Hire purchase advantages and disadvantages: Is it worth it?

To conclude, Hire Purchase has flexible repayment terms and is suitable for you if your credit is less than perfect. You pay bigger monthly instalments than with PCP or leasing, but you automatically become the owner at the end of the term.

You need to be aware of the advantages and disadvantages that are inherent to all car finance deals. Remember that missed or late payments will hurt your credit, and the interest rate will make it more expensive than buying the car outright in cash.

Hire Purchase is best for those who are certain they want to own the vehicle once the contract has expired. It's also a suitable option if you can afford a higher monthly repayment and are responsible for long financial commitments.

Contents

Latest News

| Loan amount: | £16,000 |

|---|---|

| Length of loan: | 60 months |

| Interest rate: | 12,9% |

| Amount of interest | £5,793.84 |

| Total payment: | £21,793.84 |