If you're coming to the end of your Personal Contract Purchase (PCP) agreement , you’ll have three main options: buy the car, return it, or trade it in. Each route leads to a different financial decision,vand it’s important to know what they involve before you choose.

This guide breaks down each option in plain terms. Whether you're planning ahead or making a last-minute decision, we’ll help you understand what happens and what to consider so you can choose what works best for your needs and budget.

How does PCP work?

Personal Contract Purchase (PCP) spreads the cost of driving without asking you to buy the car outright. You pay monthly instalments for a fixed term (usually 2 to 4 years) and use the car during that time.

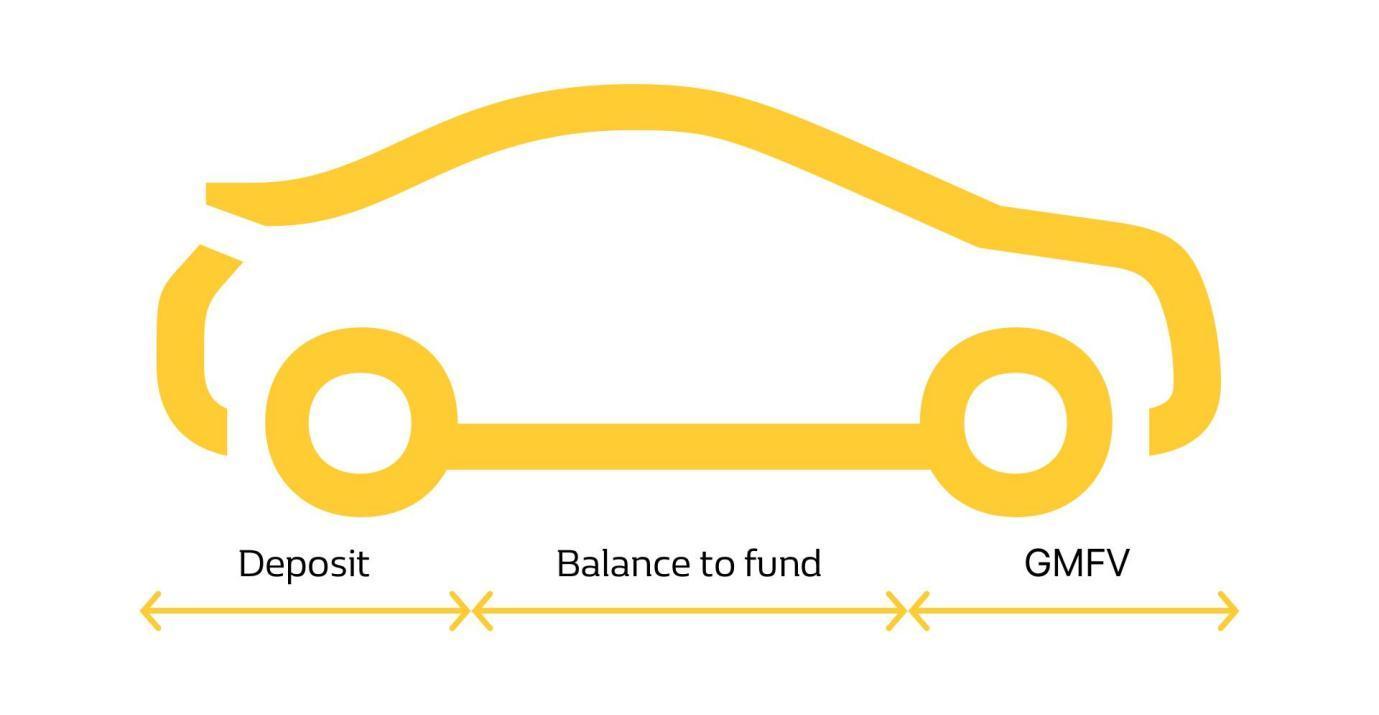

You don’t pay the car’s full price. Instead, you pay for the depreciation (the value the car loses while you use it). This is the gap between its price when new and its Guaranteed Minimum Future Value (GMFV) at the end of your agreement. GMFV is what the car is expected to be worth later, based on age, mileage, and condition.

The Guaranteed Minimum Future Value (GMFV) is what your car is expected to be worth at the end of your PCP agreement. It’s set at the start of the contract and used to calculate your monthly payments

Lenders use several factors to work it out:

- The car’s make and model

- Its fuel type (electric, petrol, diesel, hybrid)

- Your estimated annual mileage

- The length of your agreement

The finance company sets the GMFV based on market data, depreciation rates, and your usage.

Before you sign anything, check it for yourself. Look up used prices for similar models and speak to a car finance adviser. Make sure the expected future value seems fair, and that the monthly cost makes sense when interest is added.

(It’s your money. Always ask questions)

What happens at the end of a PCP term?

When your Personal Contract Purchase (PCP) agreement ends, you need to decide what to do next. Unlike Hire Purchase (HP) , where you own the car at the end, or Personal Contract Hire (PCH), where you return it, PCP gives you several options.

At the end of the agreement, you can:

- Keep the car by paying the final balloon payment.

- Change the car by starting a new PCP agreement.

- Return the car if you no longer need it.

Each option comes with its own process and possible costs.

It’s important to prepare before the agreement ends. Check your mileage, inspect the car’s condition, and read the terms of your contract. Make sure you understand any fees or checks involved. Planning early gives you more control and helps you choose the option that works best for you.

Because this isn’t about pleasing the lender. It’s about protecting yourself.

Find car finance deals with the best rates!

My monthly budget is

What can you do at the end of a PCP deal: three options

During a Personal Contract Purchase (PCP) agreement, the finance company legally owns the car. At the end of the term, you have three options and one of which allows you to take full ownership.

1. Buying your car

You can choose to keep the car by paying the final lump sum, known as the balloon payment. This amount matches the car’s Guaranteed Minimum Future Value (GMFV) (the estimated value set at the start of the agreement)

Once you pay the GMFV, ownership transfers to you. You’ll no longer make monthly payments, and the car is entirely yours.

The balloon payment can be significant, often thousands of pounds. The exact figure depends on the car’s price, your deposit , and how much you’ve paid each month. In some cases, it may be close to half of the car’s original value.

This option can make financial sense if the car is worth more than the GMFV. If the finance company sets a lower estimated value than the actual market price, you gain equity in the car, meaning it’s worth more than you pay for it.

How to refinance the final payment

If you don’t have the cash for the final payment, you can get help from a lender one more time and refinance the balloon payment, and most lenders offer this through Hire Purchase (HP).

With HP, you repay the outstanding amount in monthly instalments. No lump sum at the end. And once you've paid it off, the car is officially yours. Simple. Some lenders charge an option to purchase fee (usually around £50) just to finalise the ownership transfer.

But here’s something to think about. If you already know you want to keep the car, HP might be the better choice from the start. It’s simpler. No extra contracts. No final lump sum. And you’ll own the car outright sooner.

Checks and charges

Once you pay the final balloon payment, the finance company steps away. You take full responsibility for the car, its condition, maintenance, and value.

You won’t need to worry about checks from the lender. But if you're keeping the car, it’s still worth inspecting it yourself. Check the tyres, brakes, service history, and anything else that could affect long-term costs.

And don’t worry about mileage or damage charges. Those only apply if you return the car at the end of the agreement

Can you sell the car?

Yes, it’s your car! Once the purchase is finalised, you can do whatever you want with the car. Make sure the selling price is more than the initial deposit + all monthly payments + the balloon + interest. Unless your plan was to lose money all along.

The sale can be arranged through the same car retailer. They normally don’t mind sorting out the outstanding balance, settling the finance on your behalf and returning the surplus to you. What to do with the surplus is up to you.

2. Returning the car and walking away

You can return the car at the end of your PCP agreement and walk away with no further payments. This option works if you’ve made all monthly payments on time, stayed within the mileage limit, and kept the car in good condition.

You won’t need to pay the balloon payment. But you won’t keep the car or gain any value from it. For most drivers, this option works well when they want to avoid long-term ownership costs.

Just keep in mind: if you plan to finance or purchase another car, you’ll start a new agreement from scratch. No deposit or equity carries over from the one you’ve just finished.

When returning the car is a good idea

Returning the car at the end of your PCP agreement can be a practical choice in several situations:

- The car’s market value is lower than its Guaranteed Minimum Future Value (GMFV) - you avoid overpaying for it.

- You no longer need a vehicle. For example, if you’ve moved to a city with good public transport.

- You plan to travel for an extended period or won’t be driving regularly.

- The car meets the mileage, servicing, and condition terms or you're prepared to pay the return charges if it doesn't.

When returning the car is a bad idea

In some cases, returning the car may cost more than it's worth:

- The car is worth more than the GMFV, and by returning it, you lose the chance to gain equity or sell it privately.

- You’ve exceeded the mileage limit or missed service intervals, and the return charges are higher than expected.

- The car has damage or wear that goes beyond fair use, and you don’t want to pay for repairs.

Potential charges

Lenders expect the car to be returned in line with the condition set out in your agreement. You may face charges if the car shows signs of excessive use, damage, or missing documents.

The most common penalties include:

- Excess mileage: Your contract includes a mileage limit - often between 6,000 and 30,000 miles per year. If you go over the agreed limit, you’ll pay a charge per excess mile. This can range from 4p to 72p, depending on the lender and the car. Mileage is checked only at the end of the agreement, so if you exceed the limit in the first year but drive less later on, the average may still stay within the allowance.

- Excessive wear or damage: You may be charged if the car has issues such as deep scratches, cracks in the glass, dented panels, or stained upholstery. The car doesn’t need to be in perfect condition, but it must meet the fair wear and tear guidelines set by the lender.

- Missing documents or keys: If you return the car without key items such as the V5C logbook or a spare key, you’ll need to pay a replacement fee. These costs vary depending on what’s missing.

How to avoid the charges

Most end-of-agreement charges are avoidable, if you stay ahead.

If you know you’ll go over the mileage limit, speak to your lender early. They can update the contract to reflect your actual use. Yes, your monthly payment might rise slightly. But it’s usually cheaper than paying excess charges later. And you won’t have a last-minute panic.

To stay ahead of wear and damage, carry out regular vehicle checks. A full inspection every ten weeks gives you the chance to spot small issues before they become expensive. If you notice uneven tyre wear, brake issues, or anything unusual, ask a qualified mechanic to investigate. Always choose reliable professionals, poor repair work can lead to further problems and extra costs during return checks.

Missing items such as keys, manuals, or the V5C logbookcan also result in charges. It’s usually cheaper to replace these yourself. Most can be ordered online or collected directly from an authorised dealership. If you leave this to the finance company, you’ll likely pay more.

By staying proactive, you reduce the risk of surprise costs and keep more control over the end of your agreement.

3. Trading in or part-exchanging your car

Part-exchanging your car means using its value to reduce the cost of your next one. You return the car at the end of your PCP agreement and put any remaining value, known as equity, towards a new finance deal.

Some call it a trade-in. Others say part-exchange. Both terms describe the same thing. The key is that your car is worth more than the balloon payment. If it is, that extra value goes straight into your next agreement.

You don’t need to sell the car yourself. And you don’t need to pay the balloon payment upfront, either. The dealer handles everything in one go. They take the old car and apply the value to your next deal.

It’s quick. It’s simple. It suits drivers who want to change cars without dealing with private sales or large one-off payments.

(And yes, many people do this every few years without ever owning a car outright)

How does it work?

Part-exchanging your car gives you a smooth way to move from one vehicle to another. You return your current car and apply any equity towards your next finance deal. If your car is worth more than the remaining finance, you can use that difference as a deposit.

But if the car’s value is lower than what you still owe, you’ll need to cover the shortfall. You can either pay it in full or roll it into a new finance agreement. This often happens when you switch to Hire Purchase (HP). In that case, the outstanding balance becomes part of your new monthly payments.

The simplest way to part-exchange is through the same dealer. You can drop off your old car, complete the paperwork, and leave in a new one. No gaps. No delay. Just a straight swap with updated terms.

Of course, convenience comes at a price. Dealers often offer a trade-in value slightly below market price. That helps cover checks, servicing, and preparation for resale. But don’t dismiss the deal too quickly, the numbers can still work in your favour.

Let’s say your new car costs £10,000, and the dealer values your current car at £3,000. You’ll finance the remaining £7,000. Another dealer might offer just £2,500 for your old car, but also sell the same new model for £9,000. In that case, you’d only need to finance £6,500.

It’s not always about the trade-in figure. Look at the full offer. Then decide what works best for you.

Can you trade in a car at a different manufacturer or retailer?

Yes, you can. You’re not limited to the same manufacturer or dealer when part-exchanging your car. Many retailers accept vehicles from other brands and help settle your existing PCP agreement.

This can work in your favour, especially if another dealer offers better terms on your next car. You might get a lower price, a more flexible contract, or a model that better suits your needs.

But not every dealership accepts every vehicle. Some may only take specific makes or models, depending on their resale plans. Always ask in advance. And compare offers before you commit, and not all trade-in deals provide the same value.

Speak to a trusted adviser if you're unsure. They can help you assess the full picture and secure terms that work for you.

Trading in a car with positive equity

If a car has a £10,000 trade-in value and you only owe £5,000, this means you have £5,000worth of positive equity.

Having a surplus by the end of the PCP term is definitely an advantage. If you’re buying the new car with cash (so to speak), it’ll cost you less. If you finance the new car too, the benefit is still there. The more money you deposit initially, the lower the following monthly payments will be; alternatively, you can shorten the contract term. Think of it as another reason to take care of your existing car and keep its value as high as possible.

Trading in a car with negative equity

If a car has a £5,000 trade-in value, but you owe £6,000, a negative equity amount of £1,000. This amount must be paid out of pocket before you can go on.

This is not the smartest move. If you cover the negative equity, you potentially lose any value that you’d get through trading in. The best decision money-wise is returning the car at the end of the term (like in option #2) and financing the new car separately. It’s the lender who will deal with negative equity.

Is It Worth Buying a Car After PCP?

In some situations, yes. Buying the car at the end of your PCP agreement can offer real value.

You’re more likely to benefit if:

- You stayed well below your mileage limit

Lower mileage usually means a higher resale value. (It’s one of the first things a dealer checks) - You kept the car in excellent condition

A full service history, clean interior, and minimal wear all help preserve the car’s value. - You invested in the car

Upgrades like new tyres, improved tech, or cosmetic fixes can increase what the car is worth today. - You can save money under new rules

For example, if your car meets new emissions standards, it might avoid extra tax or low-emission charges. (Owning it could cost less than changing it) - You have a rare or limited-edition model

Some cars hold their value or even rise over time. These are often worth buying and keeping.

Before you decide, check the car’s current market value and compare it with your balloon payment. If the car is worth more, you’ll gain immediate equity and keep a car you already know and trust.

Takeaway: When the PCP Contract Ends

You can end a Personal Contract Purchase (PCP) early, but it often comes at a cost. This could involve voluntary termination or early settlement, both of which require separate steps.

If your settlement figure is £10,000 and the car’s value is lower, you’ll need to pay the difference. And if you want to keep the car early, you’ll need to make a large final payment. (It’s not cheap, better plan ahead.)

Now, here’s a quick recap of your options when your PCP ends:

- Buy the car = Pay the balloon payment to take full ownership. You can refinance this if needed. (A good option if the car’s still in great shape)

- Return the car = Give it back with nothing left to pay, as long as you’ve stayed within the mileage and condition limits.

- Trade in the car = Use the car’s value towards a new finance agreement. Many drivers choose this to keep monthly payments manageable.

Each route has its pros and cons. The best option depends on your budget, driving habits, and future plans.

PCP suits many people, but it’s not for everyone. Hire Purchase (HP) or other finance options might fit better. It all comes down to what works for you.

If you're unsure, speak to our specialist at Carplus. Or get a quote through our website. (It only takes a minute)

Table of Contents