Car finance calculator - Woking

These estimates are subject to credit checks and may change when you apply for finance. this is for example purposes only

Hire Purchase (HP)

APR 11.9%60 monthly payments of

£0

- Interest rate

- 11.9% APR

- Amount of interest

- £0

- Total payment

- £0

Personal Contract Purchase (PCP)

APR 11.9%60 monthly payments of

£0

- Optional final payment

- £0

- Interest rate

- 11.9% APR

- Amount of interest

- £0

- Total payment

- £0

Rates from 9.9% APR: the exact rate you will be offered will be based on your circumstances, subject to status. Representative Hire purchase (HP) example: borrowing £7,000 over 5 years with a representative APR of 21.9%, the annual interest rate of 21.9% (Fixed) and a deposit of £0, the amount payable would be £185.33 per month, with a total cost of credit of £4,119.81 and a total amount payable of £11,119.81. We look to find the best rate from our panel of lenders and will offer you the best deal that you're eligible for. We receive a fixed fee commission per finance agreement, or we receive a commission based on a percentage of the total amount of finance taken. This will not affect the interest rate offered or the total amount repayable. Our service is free.

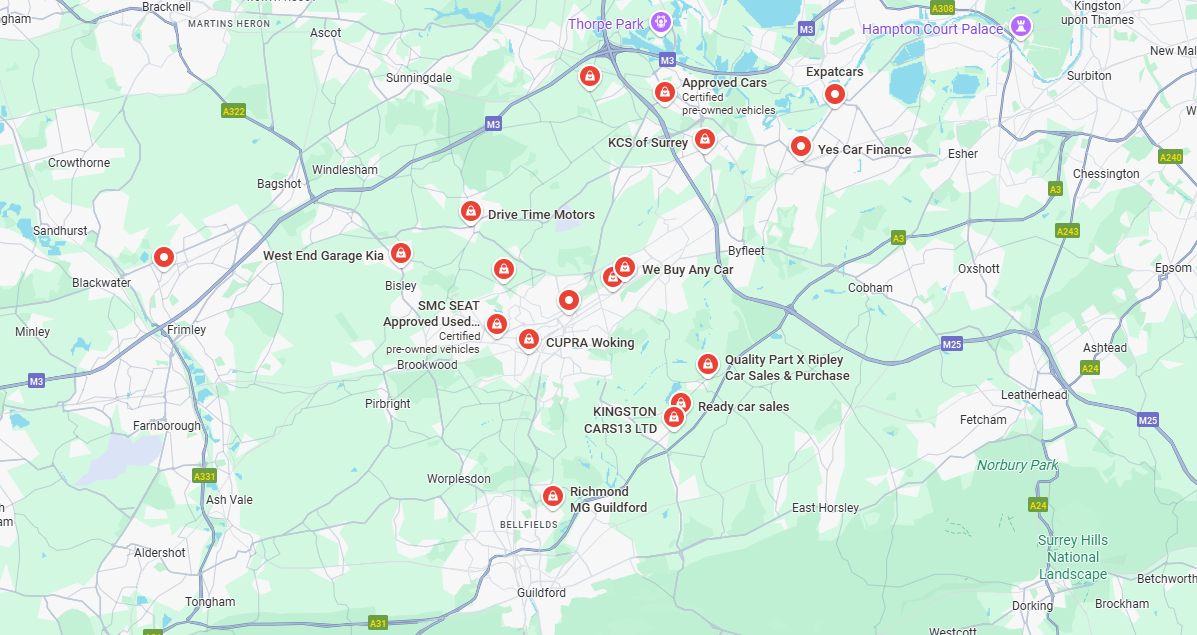

At Carplus, we make car finance simple for Woking residents who want to get on the road without stress. As a trusted car finance broker, we work with a wide panel of lenders to help you secure an agreement that suits your credit history and monthly budget. If you don’t know which car to choose yet, we’ll guide you through options that match your lifestyle and finances. You tell us what you need, we’ll find the right way to finance a car that fits.

Types of car financing we offer in Woking

At Carplus, we do more than just match numbers, we match real people in Woking with car finance solutions that actually work. Even if you’ve had issues like bad credit, we can still help you access affordable HP and PCP deals through our trusted panel of UK lenders and reputable local dealers.

Hire Purchase (HP) car finance deals

Hire Purchase is a straightforward way to spread the cost of a car. You pay in fixed monthly instalments, and once the last one is made, the car is yours, no hidden fees, no final surprises. Let’s say you’re looking at a £25,000 car. On a 5-year HP deal, your payments would sit around £500 per month, and once you’ve paid that last instalment, you’ll own the vehicle outright. It’s perfect if you want full ownership from day one and a clear path to getting there.

At Carplus, we’ll guide you through this process and help you choose a car that matches your monthly budget and lifestyle needs, whether that’s a practical family car or a fuel-efficient commuter vehicle.

Personal Contract Purchase (PCP) car finance deals

If you want more flexibility and lower monthly payments, PCP could be the right fit. You still pay fixed monthly instalments, but a large portion of the cost is pushed to the end of the agreement (known as a balloon payment). For a £25,000 car, you might pay around £350 a month over 5 years, with an optional final payment of £10,000 if you decide to keep the car. If not, you can hand it back or upgrade to a newer model.

With PCP, you don’t commit to ownership unless you’re sure and many of our Woking customers love the freedom to change cars regularly without stretching their budget.

Bad credit car finance deals in Woking

At Carplus, we specialise in helping Woking drivers secure car finance. Bad credit can happen for all sorts of reasons: missed payments, CCJs (County Court Judgments), defaults, or an IVA (Individual Voluntary Arrangement). But that doesn’t mean you have to give up on owning a car. We’ve already helped over 2,300 people in Woking get approved and drive away in vehicles they love. And with access to a wide panel of specialist lenders and local dealerships, we can offer finance options designed to work with your credit profile and not against it. You choose the car, and we’ll do the rest: from the application to finding a deal that fits your budget.

No-deposit car finance deals in Woking

No deposit car finance means you can finance a car in Woking without paying anything upfront. Instead of saving for a large initial payment, you spread the full cost of the vehicle across fixed monthly instalments. This makes it easier to budget, especially if you need a car quickly but don’t have savings ready. It’s a simple, affordable way to get on the road with less financial pressure at the start.

At Carplus, we help people with poor credit access no deposit car finance through our network of lenders and trusted dealers in Woking and across the UK. And if you've faced financial challenges before, we’ll still work to find a flexible deal that suits your circumstances. You can choose a car that fits your needs and we’ll help you finance it with no upfront cost.

Get no credit check car finance deals in Woking

At Carplus, we make it easier for you to get no credit check car finance in Woking without the stress of damaging your credit score. We only carry out soft credit searches, this means we check your profile without leaving a footprint that lenders can see. You’ll know where you stand before applying, and your score stays protected. And if you’ve had trouble with credit in the past, this is a safer way to explore your options.

We work with a wide panel of lenders who look beyond your credit score. And because we know not every lender will say yes, we find the ones most likely to approve you.

Carplus offers used cars on finance in Woking!

Carplus helps you finance quality used cars in Woking with affordable, fixed monthly payments. You choose from a wide range of vehicles, all sourced through trusted UK dealers. We check every car for reliability and match it with finance options that suit your budget and credit history. And if your credit isn’t perfect, we’ll still work to find a lender willing to support you. You get a used car you can rely on, and a finance deal that works for you.

What documents do I need to get car finance in Woking?

To get car finance in Woking with Carplus, you only need a few basic documents. Nothing complicated—just the essentials to get your application moving quickly.

Here’s what you’ll need:

- Proof you earn at least £1,200 a month

- Your full name and age (between 18 and 75)

- A valid UK driving licence

- Your job details

- Your mobile number and email address

- Proof you’ve lived in the UK for at least 12 months

Why work with Carplus in Woking?

At Carplus, we offer more than just car finance — we give you a service built around your needs. You get access to flexible deals, clear guidance, and real support from day one. And we work hard to make sure the process feels simple, not stressful.

Here’s what you can expect when you choose Carplus in Woking:

- Access to a wide panel of UK lenders – including options for bad credit

- Used cars on finance from trusted dealerships

- Soft credit checks only – no impact on your score

- Expert help choosing the right car and finance plan

- Fast decisions and a smooth, supportive process from start to finish

You focus on the car — we’ll handle the rest.

Who can get car finance in Hounslow

Need a hand? We're ready to help

Choose Carplus for a seamless and customer-focused car finance experience in Woking.

Chequers Cars Chobham

Station Rd, Chobham, Woking GU24 8AL, UK

Buckingham Car Dealership

Albert House, Albert Dr, Sheerwater, Woking GU21 5JZ, UK

12 London Road

Hamilton Court, Carthouse Ln, Horsell, Woking GU21 4XS, UK

SMC SEAT Approved Used Cars Woking

53 St Johns Rd, Woking GU21 7SA, UK